STATUS: First Edition published on Dec 21, 2021

Colophon

The animals on the cover of Mastering the Lightning Network are wood ants (Formica rufa). Commonly used to describe a broad group of ants, “wood ants” are those that either construct nests in forested areas or infest wood in a home. However, Formica rufa specifically refers to the mound-building red wood ants that are mainly found across southern Britain, northern-to-middle Europe, the Pyrenees mountain range, and Siberia. Sometimes, they are also found in North America in both coniferous and broad-leaf broken woodlands and parklands.

Also known as the southern wood ant, this subspecies of wood ants are aggressive, active, and large. The wood ant queens are typically 12–15 mm in size and can live up to 15 years. Worker ants, on the other hand, are slightly smaller at 8–10 mm and have a lifespan of anywhere between a few weeks to seven years depending on whether they’re male or female (males die soon after mating).

Capable of producing formic acid in their abdomens, red wood ants can eject it up to a few feet away when threatened by predators. Their nests are usually conspicuous mounds of grass, twigs, or conifer needles, often built against a rotting tree stump in an area that the sunlight can easily reach. Wood ants live in large colonies that may have 100,000 to 400,000 workers and 100 queens. Red wood ants are very territorial, and known to attack and remove other ant species from the area.

Red wood worker ants forage up to 50 meters from their nest to collect a natural resin found dripping from pine trees. In a behavior unique to wood ants, individual ants walk over the resin to disinfect themselves from bacteria and fungi. Additionally, they also eat aphid honeydew, small insects, and arachnids. Red wood ants are commonly used in forestry and often introduced into an area as a form of pest management.

The red wood ants are currently a protected species and are categorized as “near threatened” by the IUCN. Many of the animals on O’Reilly covers are endangered; all of them are important to the world.

The cover illustration is by Karen Montgomery, based on a black-and-white engraving from a loose plate, origin unknown. The cover fonts are Gilroy Semibold and Guardian Sans. The text font is Adobe Minion Pro; the heading font is Adobe Myriad Condensed; and the code font is Dalton Maag’s Ubuntu Mono.

About

Mastering the Lightning Network is an O’Reilly Media book, by authors Andreas M. Antonopoulos (@aantonop), Olaoluwa Osuntokun (@roasbeef), Rene Pickhardt (@renepickhardt). It was published on Dec 21, 2021, in paperback and e-book, by O’Reilly Media. It is available everywhere that books are sold. This repository contains the manuscript of the book as published by O’Reilly Media, tagged as firstedition_firstprint.

The book describes the Lightning Network (LN), a Peer-to-Peer protocol running on top of Bitcoin and other blockchains, which provides near-instant, secure, micro-payments.

The book is suitable for technical readers with an understanding of the fundamentals of Bitcoin and other open blockchains.

Preface

The Lightning Network (LN) is a second layer peer-to-peer network that allows us to make Bitcoin payments "off-chain," meaning without committing them as transactions to the Bitcoin blockchain.

The Lightning Network gives us Bitcoin payments that are secure, cheap, fast, and much more private, even for very small payments.

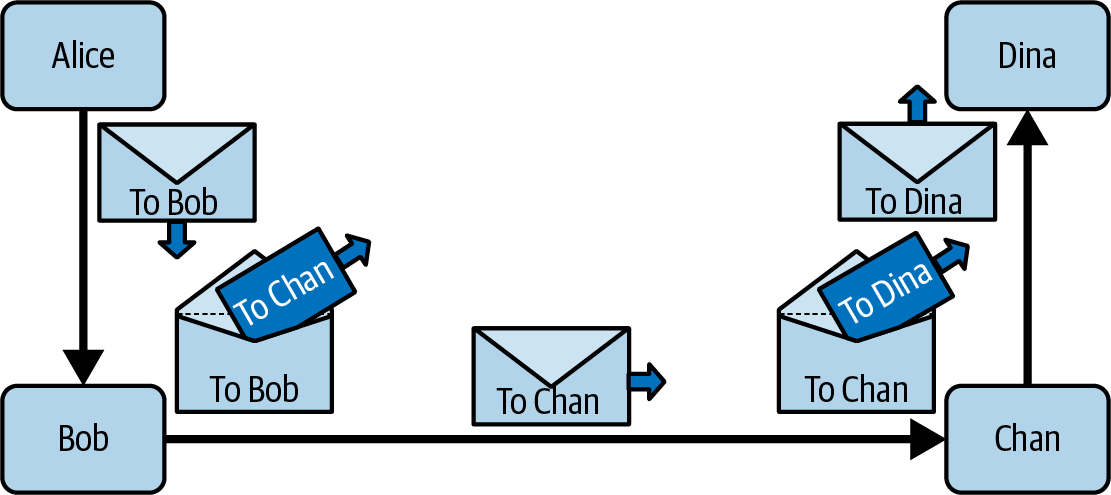

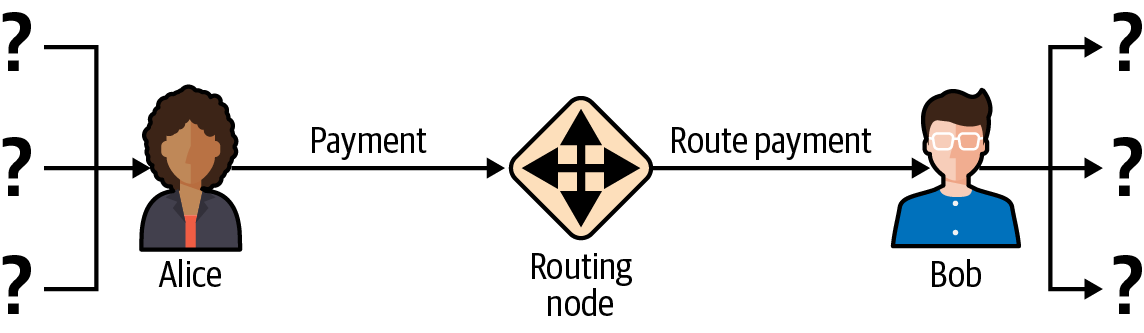

Building on the idea of payment channels, first proposed by Bitcoin’s inventor Satoshi Nakamoto, the Lightning Network is a routed network of payment channels where payments "hop" across a path of payment channels from the sender to the recipient.

The initial idea of the Lightning Network was proposed in 2015 in the groundbreaking paper "The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments," by Joseph Poon and Thaddeus Dryja. By 2017, there was a "test" Lightning Network running on the internet, as different groups built compatible implementations and coordinated to set some interoperability standards. In 2018, the Lightning Network went "live" and payments started flowing.

In 2019, Andreas M. Antonopoulos, Olaoluwa Osuntokun, and René Pickhardt agreed to collaborate to write this book. It appears we have been successful!

Intended Audience

This book is mostly intended for technical readers with an understanding of the fundamentals of Bitcoin and other open blockchains.

Conventions Used in This Book

The following typographical conventions are used in this book:

- Italic

-

Indicates new terms, URLs, email addresses, filenames, and file extensions.

- Constant width

-

Used for program listings, as well as within paragraphs to refer to program elements such as variable or function names, databases, data types, environment variables, statements, and keywords.

Constant width bold-

Shows commands or other text that should be typed literally by the user.

- Constant width italic

-

Shows text that should be replaced with user-supplied values or by values determined by context.

|

This element signifies a tip or suggestion. |

|

This element signifies a general note. |

|

This element indicates a warning or caution. |

Code Examples

The examples are illustrated in Go, C++, Python, and using the command line of a Unix-like operating system. All code snippets are available in the GitHub repository under the code subdirectory. Fork the book code, try the code examples, or submit corrections via GitHub.

All the code snippets can be replicated on most operating systems with a minimal installation of compilers, interpreters, and libraries for the corresponding languages. Where necessary, we provide basic installation instructions and step-by-step examples of the output of those instructions.

Some of the code snippets and code output have been reformatted for print. In all such cases, the lines have been split by a backslash (\) character, followed by a newline character. When transcribing the examples, remove those two characters and join the lines again and you should see identical results to those shown in the example.

All the code snippets use real values and calculations where possible, so that you can build from example to example and see the same results in any code you write to calculate the same values. For example, the private keys and corresponding public keys and addresses are all real.

Using Code Examples

If you have a technical question or a problem using the code examples, please send email to bookquestions@oreilly.com.

This book is here to help you get your job done. In general, if example code is offered with this book, you may use it in your programs and documentation. You do not need to contact us for permission unless you’re reproducing a significant portion of the code. For example, writing a program that uses several chunks of code from this book does not require permission. Selling or distributing examples from O’Reilly books does require permission. Answering a question by citing this book and quoting example code does not require permission. Incorporating a significant amount of example code from this book into your product’s documentation does require permission.

We appreciate, but do not require, attribution. An attribution usually includes the title, author, publisher, ISBN, and copyright. For example: “Mastering the Lightning Network by Andreas M. Antonopoulos, Olaoluwa Osuntokun, and René Pickhardt (O’Reilly). Copyright 2022 aantonop Books LLC, René Pickhardt, and uuddlrlrbas LLC, ISBN 978-1-492-05486-3."

Mastering the Lightning Network is offered under the Creative Commons Attribution-Noncommercial-No Derivative Works 4.0 International License (CC BY-NC-ND 4.0).

If you feel your use of code examples falls outside fair use or the permission given previously, feel free to contact us at permissions@oreilly.com.

References to Companies and Products

All references to companies and products are intended for educational, demonstration, and reference purposes. The authors do not endorse any of the companies or products mentioned. We have not tested the operation or security of any of the products, projects, or code segments shown in this book. Use them at your own risk!

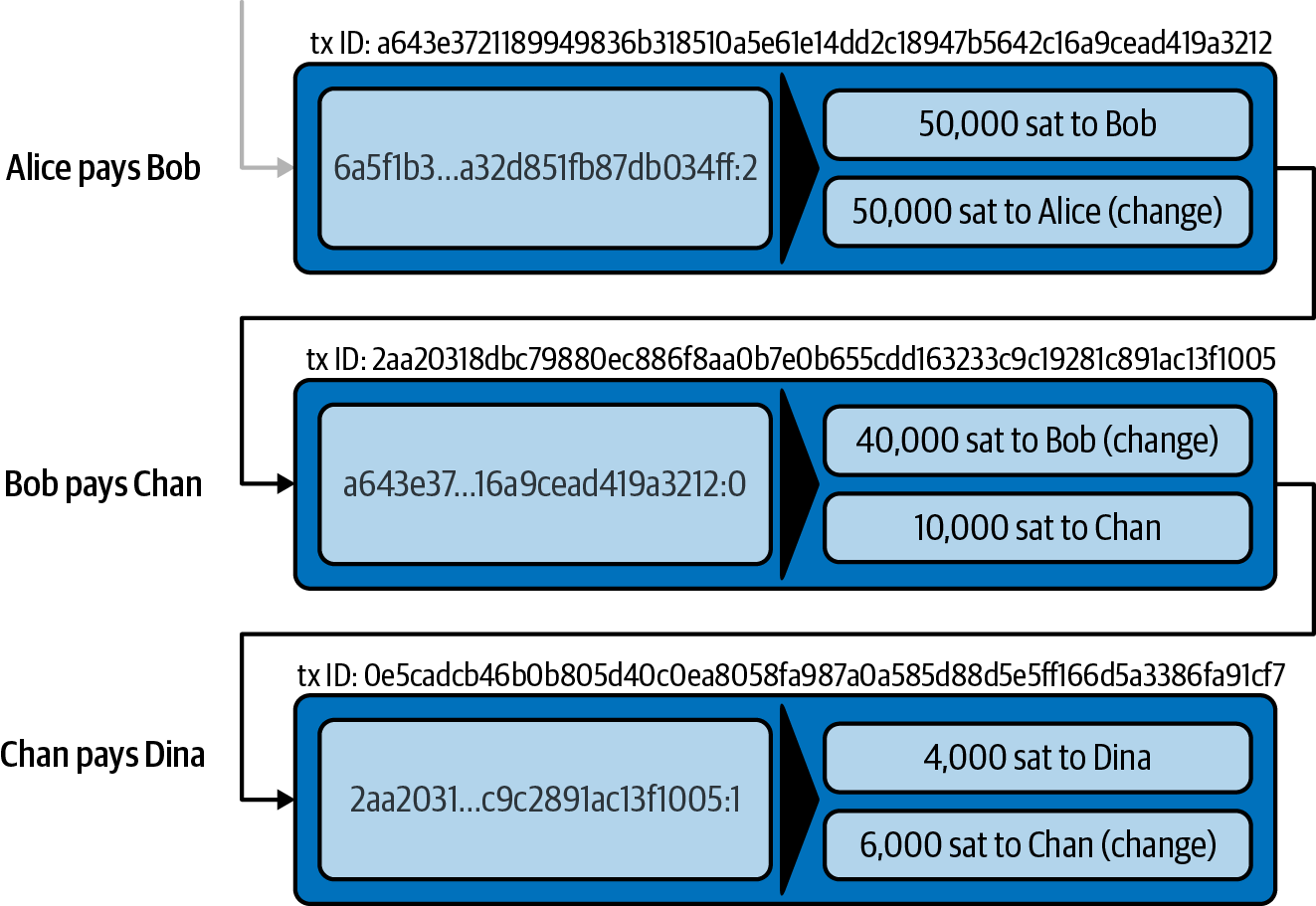

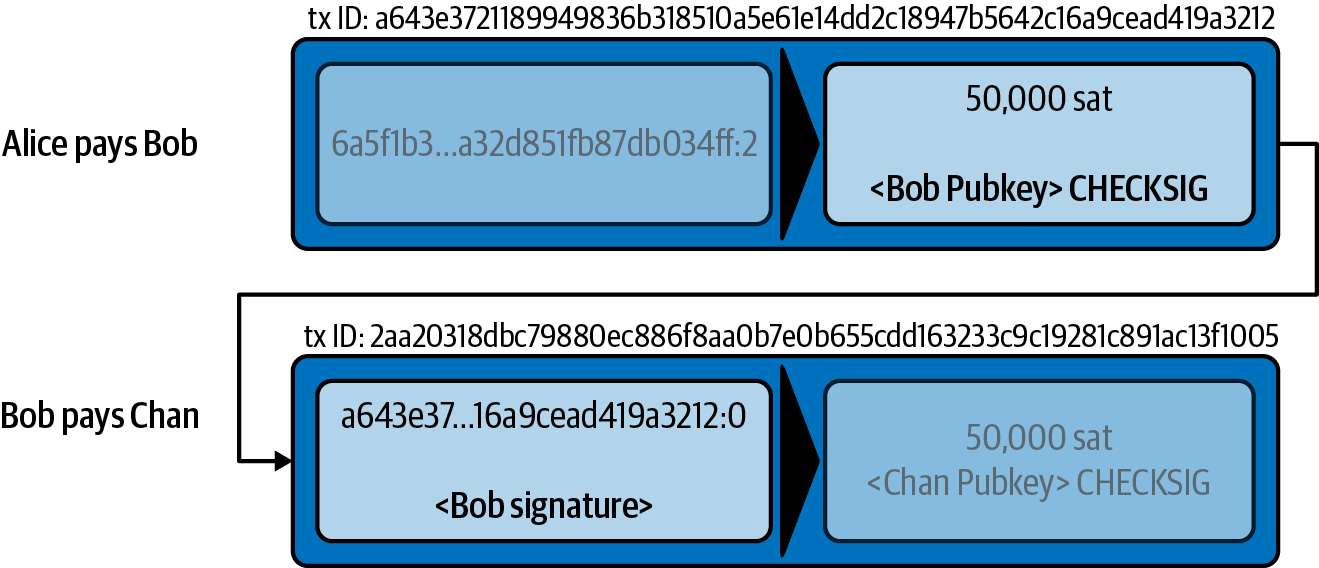

Addresses and Transactions in This Book

The Bitcoin addresses, transactions, keys, QR codes, and blockchain data used in this book are, for the most part, real. That means you can browse the blockchain, look at the transactions offered as examples, retrieve them with your own scripts or programs, etc.

However, note that the private keys used to construct the addresses printed in this book have been "burned." This means that if you send money to any of these addresses, the money will either be lost forever or (more likely) appropriated, since anyone who reads the book can take it using the private keys printed herein.

|

DO NOT SEND MONEY TO ANY OF THE ADDRESSES IN THIS BOOK. Your money will be taken by another reader, or lost forever. |

O’Reilly Online Learning

|

For more than 40 years, O’Reilly Media has provided technology and business training, knowledge, and insight to help companies succeed. |

Our unique network of experts and innovators share their knowledge and expertise through books, articles, and our online learning platform. O’Reilly’s online learning platform gives you on-demand access to live training courses, in-depth learning paths, interactive coding environments, and a vast collection of text and video from O’Reilly and 200+ other publishers. For more information, visit http://oreilly.com.

How to Contact Us

Information about Mastering the Lightning Network as well as the Open Edition and translations are available at https://lnbook.info.

Please address comments and questions concerning this book to the publisher:

- O’Reilly Media, Inc.

- 1005 Gravenstein Highway North

- Sebastopol, CA 95472

- 800-998-9938 (in the United States or Canada)

- 707-829-0515 (international or local)

- 707-829-0104 (fax)

Email bookquestions@oreilly.com to comment or ask technical questions about this book.

For news and information about our books and courses, visit http://oreilly.com.

Find us on Facebook: http://facebook.com/oreilly

Follow us on Twitter: http://twitter.com/oreillymedia

Watch us on YouTube: http://www.youtube.com/oreillymedia

Contacting Andreas

You can contact Andreas M. Antonopoulos on his personal site: https://aantonop.com

Subscribe to Andreas’s channel on YouTube: https://www.youtube.com/aantonop

Like Andreas’s page on Facebook: https://www.facebook.com/AndreasMAntonopoulos

Follow Andreas on Twitter: https://twitter.com/aantonop

Connect with Andreas on LinkedIn: https://linkedin.com/company/aantonop

Andreas would also like to thank the patrons who support his work through monthly donations. You can support Andreas on Patreon at https://patreon.com/aantonop.

Contacting René

You can contact René Pickhardt on his personal site: https://ln.rene-pickhardt.de

Subscribe to René’s channel on YouTube: https://www.youtube.com/user/RenePickhardt

Follow René on Twitter: https://twitter.com/renepickhardt

Connect with René on LinkedIn: https://www.linkedin.com/in/rene-pickhardt-80313744

René would also like to thank all of the patrons who support his work through monthly donations. You can support René on Patreon at https://patreon.com/renepickhardt.

Or you can support his work directly with Bitcoin (also via the Lightning Network) at https://donate.ln.rene-pickhardt.de for which René is equally thankful as for his patreons.

Contacting Olaoluwa Osuntokun

You can contact Olaoluwa Osuntokun at his professional email address: laolu@lightning.engineering

Follow Olaoluwa on Twitter: https://twitter.com/roasbeef

Acknowledgments by Andreas

I owe my love of words and books to my mother, Theresa, who raised me in a house with books lining every wall. My mother also bought me my first computer in 1982, despite being a self-described technophobe. My father, Menelaos, a civil engineer who published his first book at 80 years old, was the one who taught me logical and analytical thinking and a love of science and engineering.

Thank you all for supporting me throughout this journey.

Acknowledgments by René

I want to thank the German education system through which I acquired the knowledge upon which my work builds. It is one of the greatest gifts I was given. Similarly I want to thank the German public healthcare system and every person devoting their time into working within that industry. Your effort and endurance make you my personal heroes and I will never forget the help, patience, and support I received when I was in need. Thanks goes to all the students I was allowed to teach and who engaged in interesting discussions and questions. From you I learned the most. I am also grateful to the Bitcoin and Lightning Network community that warmly welcomed me and to the enthusiasts and private persons who financially supported and continue to support my work. In particular I am grateful to all the open source developers (not only Bitcoin and Lightning Network) and to the people who fund them to make that technology possible. A special thanks goes to my coauthors for riding with me through the storm. Last but not least, I am thankful to my loved ones.

Acknowledgments by Olaoluwa Osuntokun

I’d like to thank the amazing team at Lightning Labs, as without you all, there would be no LND. I’d also like to thank the original set of authors of the BOLT specification: Rusty Russell, Fabrice Drouin, Conner Fromnkchet, Pierre-Marie Padiou, Lisa Neigut, and Christian Decker. Last but not least, I’d like to thank Joseph Poon and Tadge Dryja, the authors of the original Lightning Network paper, as without them, there would be no Lightning Network to write a book about.

Contributions

Many contributors offered comments, corrections, and additions to the book as it was collaboratively written on GitHub.

Following is an alphabetically sorted list of all the GitHub contributors, including their GitHub IDs in parentheses:

-

8go (@8go)

-

Aaqil Aziz (@batmanscode)

-

Alexander Gnip (@quantumcthulhu)

-

Alpha Q. Smith (@alpha_github_id)

-

Ben Skee (@benskee)

-

Brian L. McMichael (@brianmcmichael)

-

CandleHater (@CandleHater)

-

Daniel Gockel (@dancodery)

-

Dapeng Li (@luislee818)

-

Darius E. Parvin (@DariusParvin)

-

Doru Muntean (@chriton)

-

Eduardo Lima III (@elima-iii)

-

Emilio Norrmann (@enorrmann)

-

Francisco Calderón (@grunch)

-

Francisco Requena (@FrankyFFV)

-

François Degros (@fdegros)

-

Giovanni Zotta (@GiovanniZotta)

-

Gustavo Silva (@GustavoRSSilva)

-

Guy Thayakorn (@saguywalker)

-

Haoyu Lin (@HAOYUatHZ)

-

Hatim Boufnichel (@boufni95)

-

Imran Lorgat (@ImranLorgat)

-

Jeffrey McLarty (@jnmclarty)

-

John Davies (@tigeryant)

-

Julien Wendling (@trigger67)

-

Jussi Tiira (@juhi24)

-

Kory Newton (@korynewton)

-

Lawrence Webber (@lwebbz)

-

Luigi (@gin)

-

Maximilian Karasz (@mknoszlig)

-

Omega X. Last (@omega_github_id)

-

Owen Gunden (@ogunden)

-

Patrick Lemke (@PatrickLemke)

-

Paul Wackerow (@wackerow)

-

Randy McMillan (@RandyMcMillan)

-

René Köhnke (@rene78)

-

Ricardo Marques (@RicardoM17)

-

Sebastian Falbesoner (@theStack)

-

Sergei Tikhomirov (@s-tikhomirov)

-

Severin Alexander Bühler (@SeverinAlexB)

-

Simone Bovi (@SimoneBovi)

-

Srijan Bhushan (@srijanb)

-

Taylor Masterson (@tjmasterson)

-

Umar Bolatov (@bolatovumar)

-

Warren Wan (@wlwanpan)

-

Yibin Zhang (@z4y1b2)

-

Zachary Haddenham (@senf42)

Without the help offered by everyone listed here, this book would not have been possible. Your contributions demonstrate the power of open source and open culture, and we are eternally grateful for your help.

Thank you.

Sources

Some of the material in this book has been sourced from a variety of public domain sources, open license sources, or with permission. See Sources and License Notices for source, license, and attribution details.

Part 1

01 Introduction

Welcome to Mastering the Lightning Network!

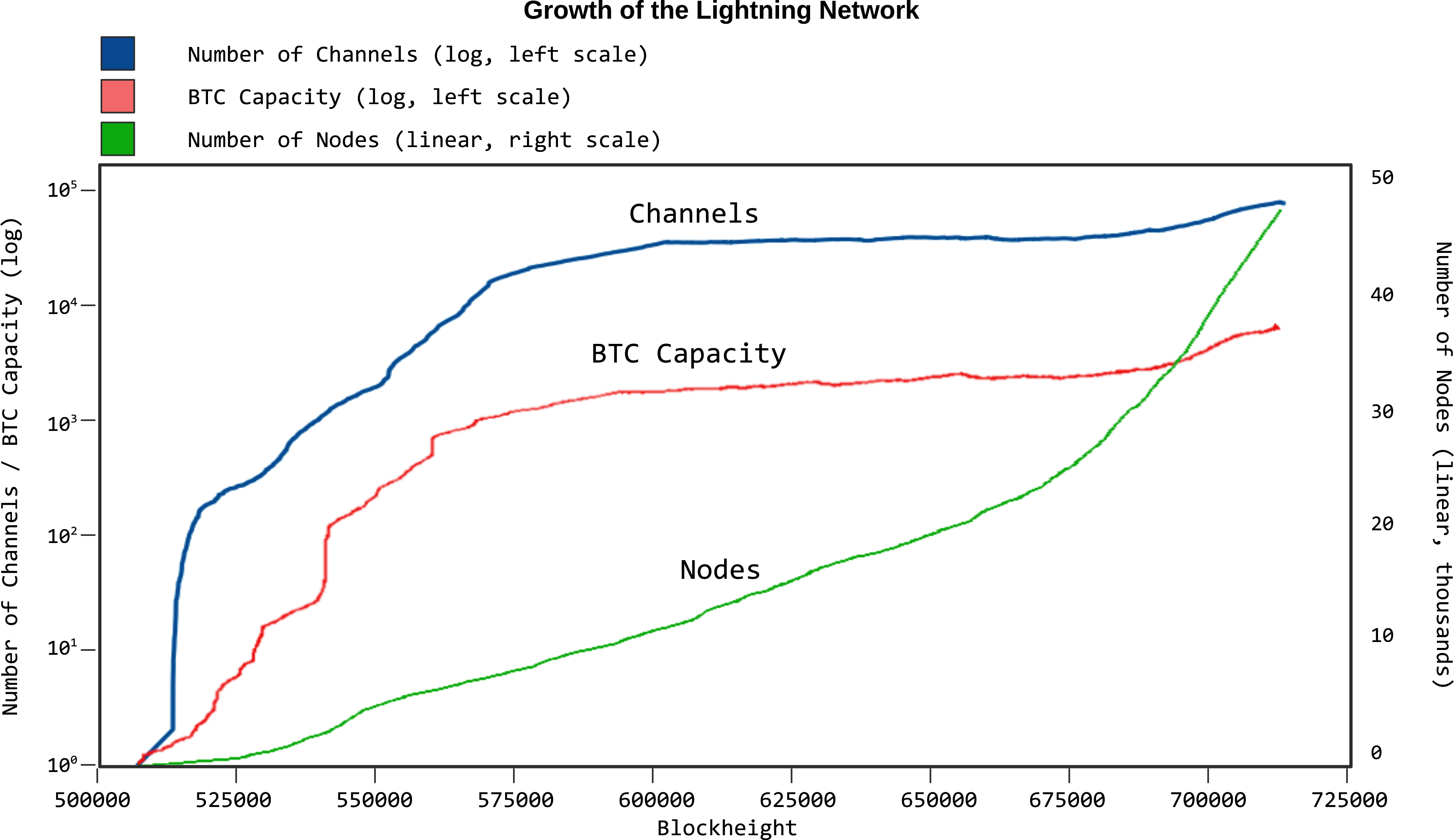

The Lightning Network (often abbreviated as LN), is changing the way people exchange value online, and it’s one of the most exciting advancements to happen in Bitcoin’s history. Today, in 2021, the Lightning Network is still in its infancy. The Lightning Network is a protocol for using Bitcoin in a smart and nonobvious way. It is a second layer technology on top of Bitcoin.

The concept of the Lightning Network was proposed in 2015, and the first implementation was launched in 2018. As of 2021, we’re only beginning to see the opportunities the Lightning Network provides to Bitcoin, including improved privacy, speed, and scale. With core knowledge of the Lightning Network, you can help shape the future of the network while also building opportunities for yourself.

We assume you already have some basic knowledge about Bitcoin, but if not, don’t worry—we will explain the most important Bitcoin concepts, those you must know to understand the Lightning Network, in Bitcoin Fundamentals Review. If you want to learn more about Bitcoin, you can read Mastering Bitcoin, 2nd edition, by Andreas M. Antonopoulos (O’Reilly), available for free online.

While the bulk of this book is written for programmers, the first few chapters are written to be approachable by anyone regardless of technical experience. In this chapter, we’ll start with some terminology, then move to look at trust and its application in these systems, and finally we’ll discuss the history and future of the Lightning Network. Let’s get started.

Lightning Network Basic Concepts

As we explore how the Lightning Network actually works, we will encounter some technical terminology that might, at first, be a bit confusing. While all of these concepts and terms will be explained in detail as we progress through the book and are defined in the glossary, some basic definitions now will make it easier to understand the concepts in the next two chapters. If you don’t understand all of the words in these definitions yet, that’s OK. You’ll understand more as you move through the text.

- Blockchain

-

A distributed transaction ledger, produced by a network of computers. Bitcoin, for example, is a system that produces a blockchain. The Lightning Network is not itself a blockchain, nor does it produce a blockchain. It is a network that relies on an existing external blockchain for its security.

- Digital signature

-

A digital signature is a mathematical scheme for verifying the authenticity of digital messages or documents. A valid digital signature gives a recipient reason to believe that the message was created by a known sender, that the sender cannot deny having sent the message, and that the message was not altered in transit.

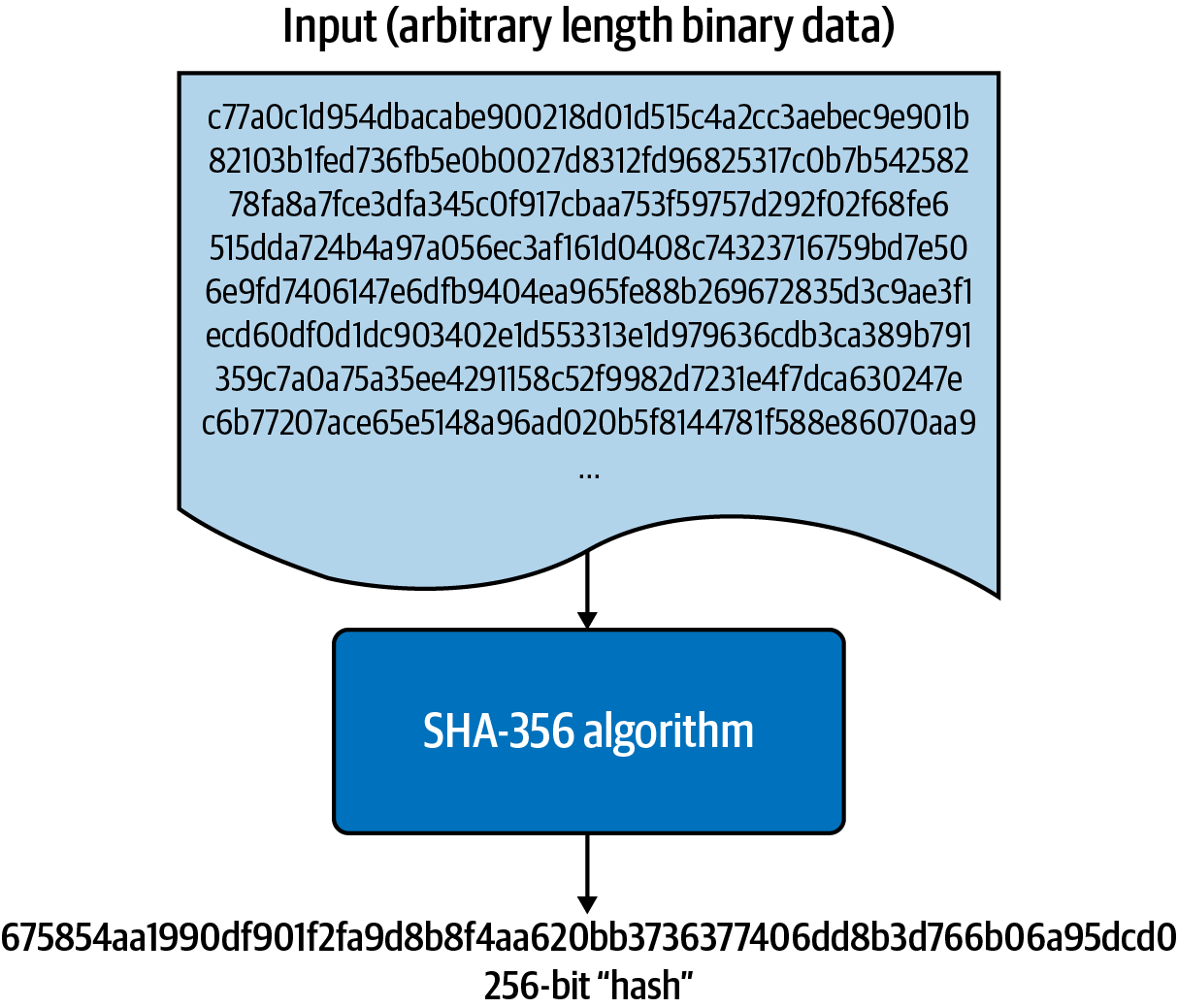

- Hash function

-

A cryptographic hash function is a mathematical algorithm that maps data of arbitrary size to a bit string of a fixed size (a hash) and is designed to be a one-way function, that is, a function which is infeasible to invert.

- Node

-

A computer that participates in a network. A Lightning node is a computer that participates in the Lightning Network. A Bitcoin node is a computer that participates in the Bitcoin network. Typically an LN user will run a Lightning node and a Bitcoin node.

- On-chain versus off-chain

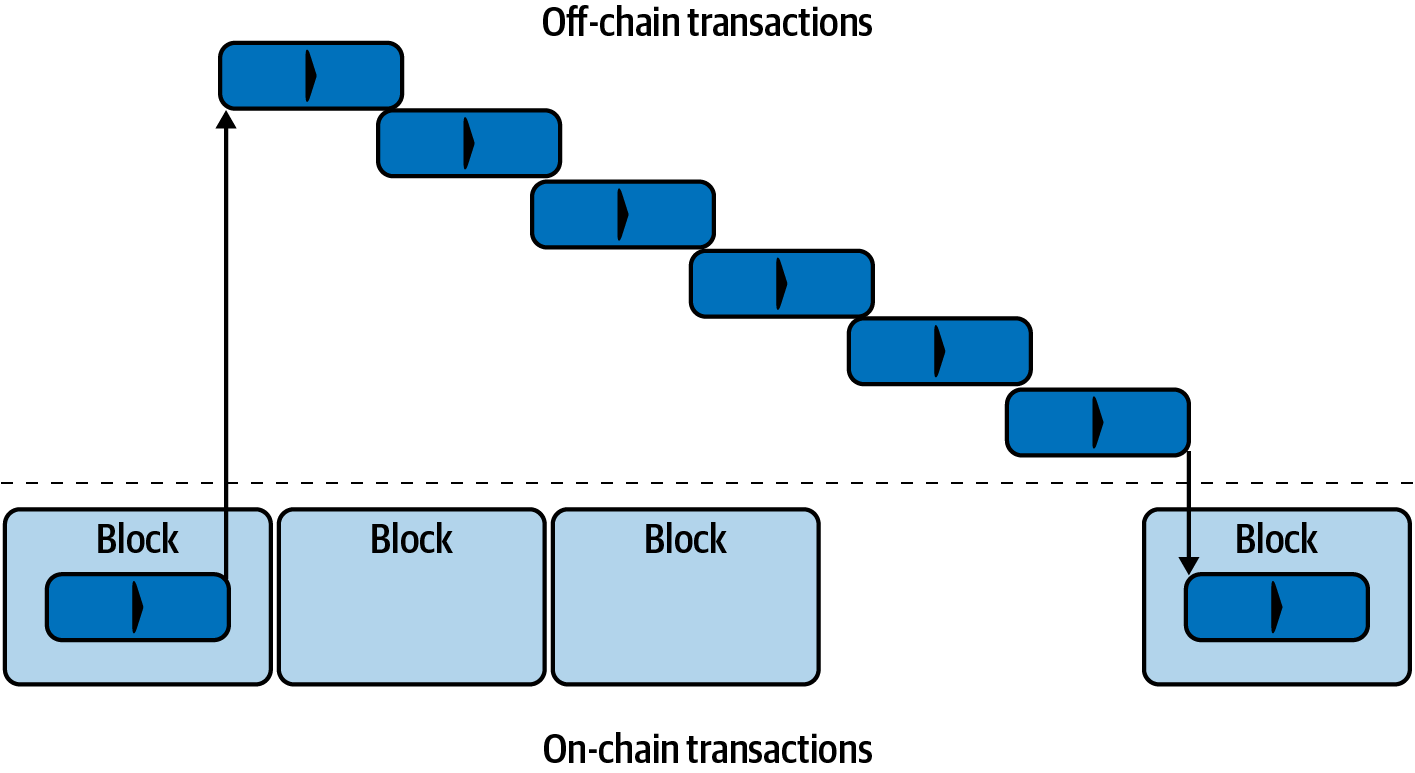

-

A payment is on-chain if it is recorded as a transaction on the Bitcoin (or other underlying) blockchain. Payments sent via payment channels between Lightning nodes, and which are not visible in the underlying blockchain, are called off-chain payments. Usually in the Lightning Network, the only on-chain transactions are those used to open and close a Lightning payment channel. A third type of channel modifying transaction exists, called splicing, which can be used to add/remove the amount of funds committed in a channel.

- Payment

-

When value is exchanged on the Lightning Network, we call this a "payment" as compared to a "transaction" on the Bitcoin blockchain.

- Payment channel

-

A financial relationship between two nodes on the Lightning Network, typically implemented by multisignature Bitcoin transactions that share control over bitcoin between the two Lightning nodes.

- Routing versus sending

-

Unlike Bitcoin where transactions are "sent" by broadcasting them to everyone, Lightning is a routed network where payments are "routed" across one or more payment channels following a path from sender to recipient.

- Transaction

-

A data structure that records the transfer of control over some funds (e.g., some bitcoin). The Lightning Network relies on Bitcoin transactions (or those of another blockchain) to track control of funds.

More detailed definitions of these and many other terms can be found in the Glossary. Throughout this book, we will explain what these concepts mean and how these technologies actually work.

|

Throughout this book, you will see "Bitcoin" with the first letter capitalized, which refers to the Bitcoin system and is a proper noun. You will also see "bitcoin," with a lowercase b, which refers to the currency unit. Each bitcoin is further subdivided into 100 million units each called a "satoshi" (singular) or "satoshis" (plural). |

Now that you’re familiar with these basic terms, let’s move to a concept you are already comfortable with: trust.

Trust in Decentralized Networks

You will often hear people calling Bitcoin and the Lightning Network "trustless." At first glance this is confusing. After all, isn’t trust a good thing? Banks even use it in their names! Isn’t a "trustless" system, a system devoid of trust, a bad thing?

The use of the word "trustless" is intended to convey the ability to operate without needing trust in the other participants in the system. In a decentralized system like Bitcoin, you can always choose to transact with someone you trust. However, the system ensures you can’t be cheated even if you can’t trust the other party in a transaction. Trust is a nice-to-have instead of a must-have property of the system.

Contrast that to traditional systems like banking where you must place your trust in a third party, since it controls your money. If the bank violates your trust, you may be able to find some recourse from a regulator or court, but at an enormous cost of time, money, and effort.

Trustless does not mean devoid of trust. It means that trust is not a necessary prerequisite to all transactions and that you can transact even with people you don’t trust because the system prevents cheating.

Before we get into how the Lightning Network works, it’s important to understand one basic concept that underlies Bitcoin, the Lightning Network, and many other such systems: something we call a fairness protocol. A fairness protocol is a way to achieve fair outcomes between participants, who do not need to trust each other, without the need for a central authority, and it is the backbone of decentralized systems like Bitcoin.

Fairness Without Central Authority

When people have competing interests, how can they establish enough trust to engage in some cooperative or transactional behavior? The answer to this question lies at the core of several scientific and humanistic disciplines, such as economics, sociology, behavioral psychology, and mathematics. Some of those disciplines give us "soft" answers that depend on concepts such as reputation, fairness, morality, and even religion. Other disciplines give us concrete answers that depend only on the assumption that the participants in these interactions will act rationally, with their self-interest as the main objective.

In broad terms, there are a handful of ways to ensure fair outcomes in interactions between individuals who may have competing interests:

- Require trust

-

You only interact with people whom you already trust, due to prior interactions, reputation, or familial relationships. This works well enough at small scale, especially within families and small groups, that it is the most common basis for cooperative behavior. Unfortunately, it doesn’t scale and it suffers from tribalist (in-group) bias.

- Rule of law

-

Establish rules for interactions that are enforced by an institution. This scales better, but it cannot scale globally due to differences in customs and traditions, as well as the inability to scale the institutions of enforcement. One nasty side effect of this solution is that the institutions become more and more powerful as they get bigger and that may lead to corruption.

- Trusted third parties

-

Put an intermediary in every interaction to enforce fairness. Combined with the "rule of law" to provide oversight of intermediaries, this scales better, but suffers from the same imbalance of power: the intermediaries get very powerful and may attract corruption. Concentration of power leads to systemic risk and systemic failure ("too big to fail").

- Game theoretical fairness protocols

-

This last category emerges from the combination of the internet and cryptography and is the subject of this section. Let’s see how it works and what its advantages and disadvantages are.

Trusted Protocols Without Intermediaries

Cryptographic systems like Bitcoin and the Lightning Network are systems that allow you to transact with people (and computers) that you don’t trust. This is often referred to as "trustless" operation, even though it is not actually trustless. You have to trust in the software that you run, and you have to trust that the protocol implemented by that software will result in fair outcomes.

The big distinction between a cryptographic system like this and a traditional financial system is that in traditional finance you have a trusted third party, for example a bank, to ensure that outcomes are fair. A significant problem with such systems is that they give too much power to the third party, and they are also vulnerable to a single point of failure. If the trusted third party itself violates trust or attempts to cheat, the basis of trust breaks.

As you study cryptographic systems, you will notice a certain pattern: instead of relying on a trusted third party, these systems attempt to prevent unfair outcomes by using a system of incentives and disincentives. In cryptographic systems you place trust in the protocol, which is effectively a system with a set of rules that, if properly designed, will correctly apply the desired incentives and disincentives. The advantage of this approach is twofold: not only do you avoid trusting a third party, you also reduce the need to enforce fair outcomes. So long as the participants follow the agreed protocol and stay within the system, the incentive mechanism in that protocol achieves fair outcomes without enforcement.

The use of incentives and disincentives to achieve fair outcomes is one aspect of a branch of mathematics called game theory, which studies "models of strategic interaction among rational decision makers."[1] Cryptographic systems that control financial interactions between participants, such as Bitcoin and the Lightning Network, rely heavily on game theory to prevent participants from cheating and allow participants who don’t trust each other to achieve fair outcomes.

While game theory and its use in cryptographic systems may appear confounding and unfamiliar at first, chances are you’re already familiar with these systems in your everyday life; you just don’t recognize them yet. In the following section we’ll use a simple example from childhood to help us identify the basic pattern. Once you understand the basic pattern, you will see it everywhere in the blockchain space and you will come to recognize it quickly and intuitively.

In this book, we call this pattern a fairness protocol, defined as a process that uses a system of incentives and/or disincentives to ensure fair outcomes for participants who don’t trust each other. Enforcement of a fairness protocol is only necessary to ensure that the participants can’t escape the incentives or disincentives.

A Fairness Protocol in Action

Let’s look at an example of a fairness protocol that you may already be familiar with.

Imagine a family lunch, with a parent and two children. The children are fussy eaters and the only thing they will agree to eat is fried potatoes. The parent has prepared a bowl of fried potatoes ("french fries" or "chips" depending on which English dialect you use). The two siblings must share the plate of chips. The parent must ensure a fair distribution of chips to each child; otherwise, the parent will have to hear constant complaining (maybe all day), and there’s always a possibility of an unfair situation escalating to violence. What is a parent to do?

There are a few different ways that fairness can be achieved in this strategic interaction between two siblings that do not trust each other and have competing interests. The naive but commonly used method is for the parent to use their authority as a trusted third party: they split the bowl of chips into two servings. This is similar to traditional finance, where a bank, accountant, or lawyer acts as a trusted third party to prevent any cheating between two parties who want to transact.

The problem with this scenario is that it vests a lot of power and responsibility in the hands of the trusted third party. In this example, the parent is fully responsible for the equal allocation of chips, and the parties merely wait, watch, and complain. The children accuse the parent of playing favorites and not allocating the chips fairly. The siblings fight over the chips, yelling "that chip is bigger!" and dragging the parent into their fight. It sounds awful, doesn’t it? Should the parent yell louder? Take all of the chips away? Threaten to never make chips again and let those ungrateful children go hungry?

A much better solution exists: the siblings are taught to play a game called "split and choose." At each lunch one sibling splits the bowl of chips into two servings and the other sibling gets to choose which serving they want. Almost immediately, the siblings figure out the dynamic of this game. If the one splitting makes a mistake or tries to cheat, the other sibling can "punish" them by choosing the bigger bowl. It is in the best interest of both siblings, but especially the one splitting the bowl, to play fair. Only the cheater loses in this scenario. The parent doesn’t even have to use their authority or enforce fairness. All the parent has to do is enforce the protocol; as long as the siblings cannot escape their assigned roles of "splitter" and "chooser," the protocol itself ensures a fair outcome without the need for any intervention. The parent can’t play favorites or distort the outcome.

|

While the infamous chip battles of the 1980s neatly illustrate the point, any similarity between the preceding scenario and any of the authors' actual childhood experiences with their cousins is entirely coincidental…or is it? |

Security Primitives as Building Blocks

In order for a fairness protocol like this to work, there need to be certain guarantees, or security primitives, that can be combined to ensure enforcement. The first security primitive is strict time ordering/sequencing: the "splitting" action must happen before the "choosing" action. It’s not immediately obvious, but unless you can guarantee that action A happens before action B, then the protocol falls apart. The second security primitive is commitment with nonrepudiation. Each sibling must commit to their choice of role: either splitter or chooser. Also, once the splitting has been completed, the splitter is committed to the split they created—they cannot repudiate that choice and go try again.

Cryptographic systems offer a number of security primitives that can be combined in different ways to construct a fairness protocol. In addition to sequencing and commitment, we can also use many other tools:

-

Hash functions to fingerprint data, as a form of commitment, or as the basis for a digital signature

-

Digital signatures for authentication, nonrepudiation, and proof of ownership of a secret

-

Encryption/decryption to restrict access to information to authorized participants only

This is only a small list of a whole "menagerie" of security and cryptographic primitives that are in use. More basic primitives and combinations are invented all the time.

In our real-life example, we saw one form of fairness protocol called "split and choose." This is just one of a myriad different fairness protocols that can be built by combining the building blocks of security primitives in different ways. But the basic pattern is always the same: two or more participants interact without trusting each other by engaging in a series of steps that are part of an agreed protocol. The protocol’s steps arrange incentives and disincentives to ensure that if the participants are rational, cheating is counterproductive and fairness is the automatic outcome. Enforcement is not necessary to get fair outcomes—it is only necessary to keep the participants from breaking out of the agreed protocol.

Now that you understand this basic pattern, you will start seeing it everywhere in Bitcoin, the Lightning Network, and many other systems. Let’s look at some specific examples next.

Example of the Fairness Protocol

The most prominent example of a fairness protocol is Bitcoin’s consensus algorithm, Proof of Work (PoW). In Bitcoin, miners compete to verify transactions and aggregate them in blocks. To ensure that the miners do not cheat, without entrusting them with authority, Bitcoin uses a system of incentives and disincentives. Miners have to use electricity and dedicate hardware doing "work" that is embedded as a "proof" inside every block. This is achieved because of a property of hash functions where the output value is randomly distributed across the entire range of possible outputs. If miners succeed in producing a valid block fast enough, they are rewarded by earning the block reward for that block. Forcing miners to use a lot of electricity before the network considers their block means that they have an incentive to correctly validate the transactions in the block. If they cheat or make any kind of mistake, their block is rejected and the electricity they used to "prove" it is wasted. No one needs to force miners to produce valid blocks; the reward and punishment incentivize them to do so. All the protocol needs to do is ensure that only valid blocks with Proof of Work are accepted.

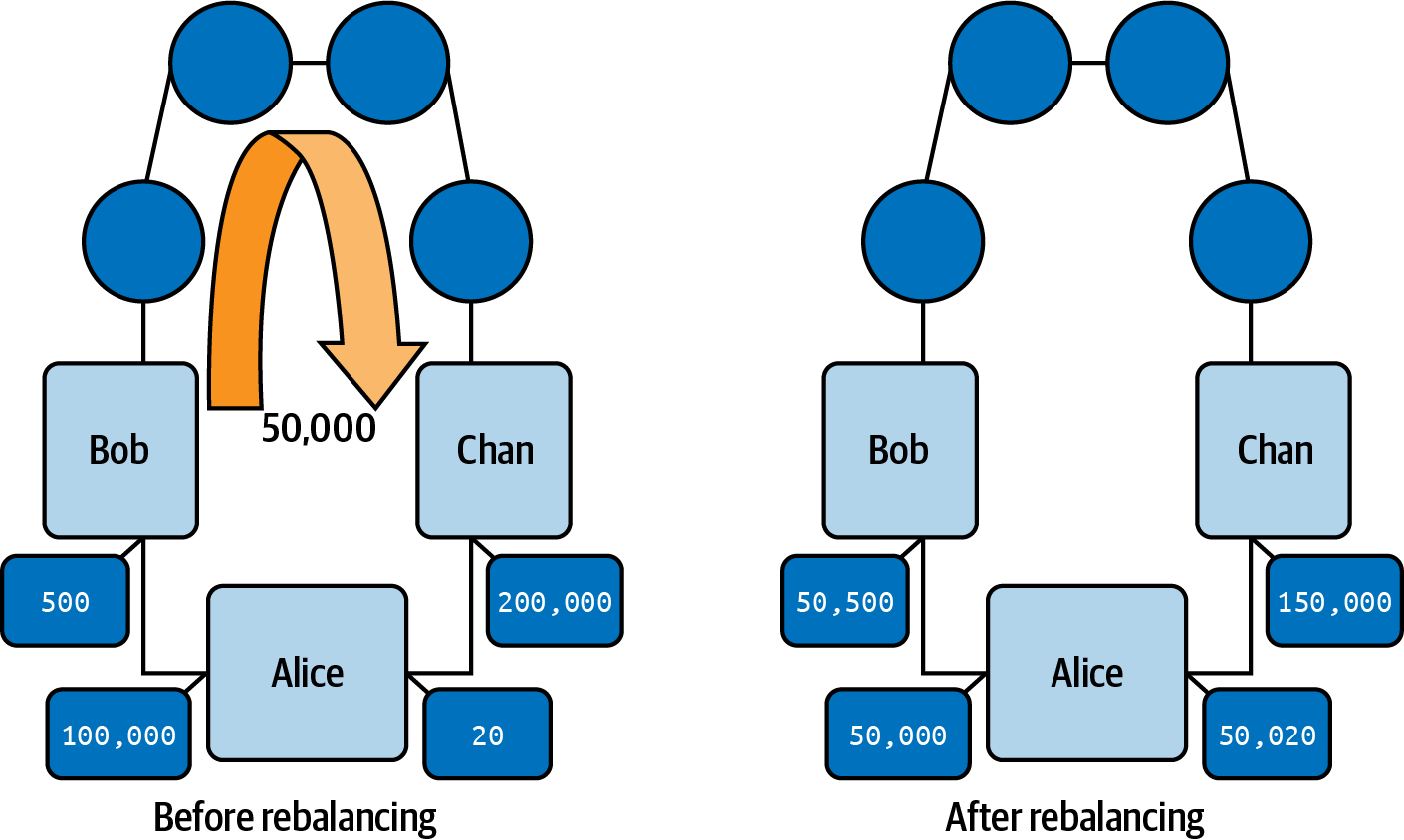

The fairness protocol pattern can also be found in many different aspects of the Lightning Network:

-

Those who fund channels make sure that they have a refund transaction signed before they publish the funding transaction.

-

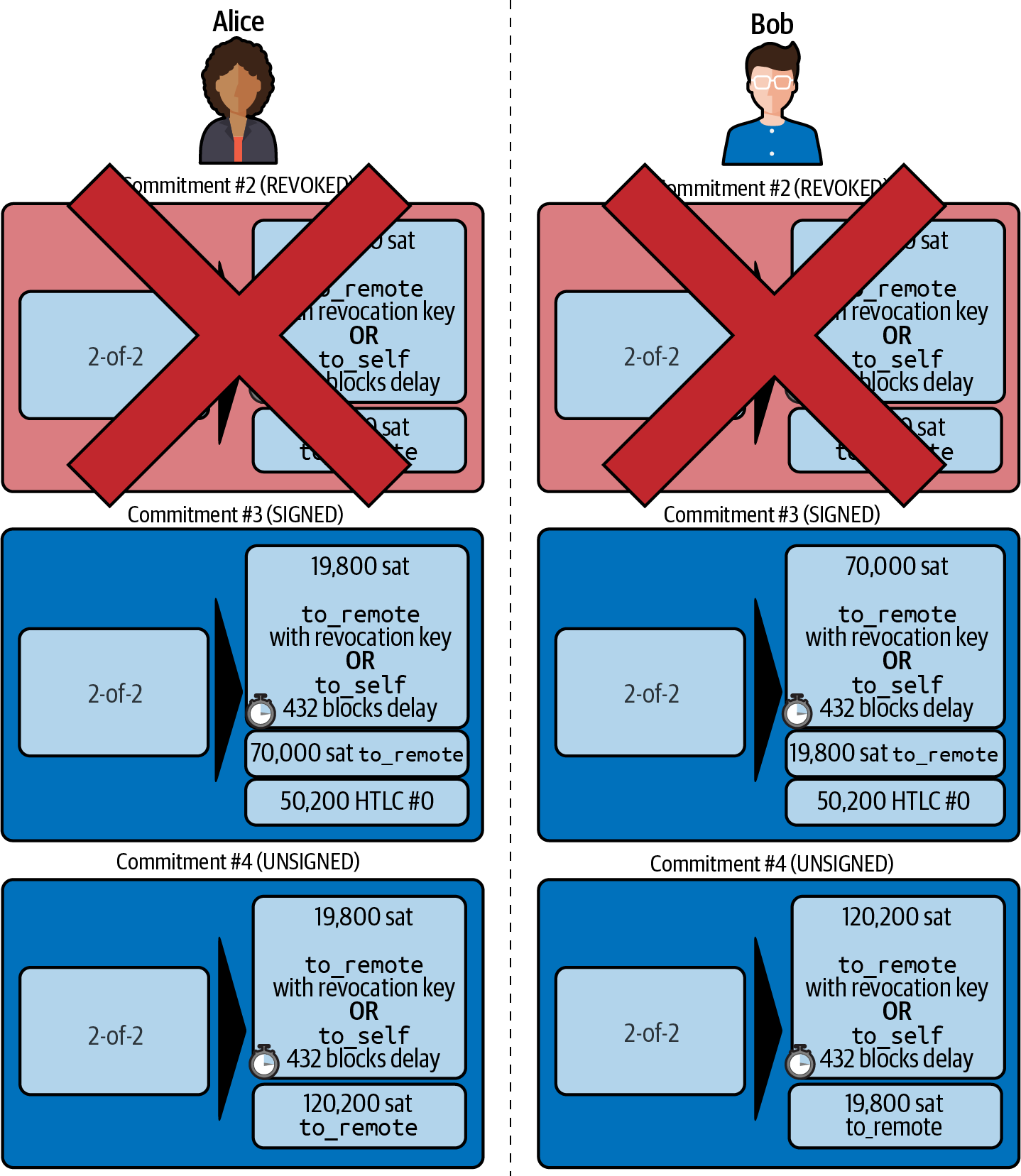

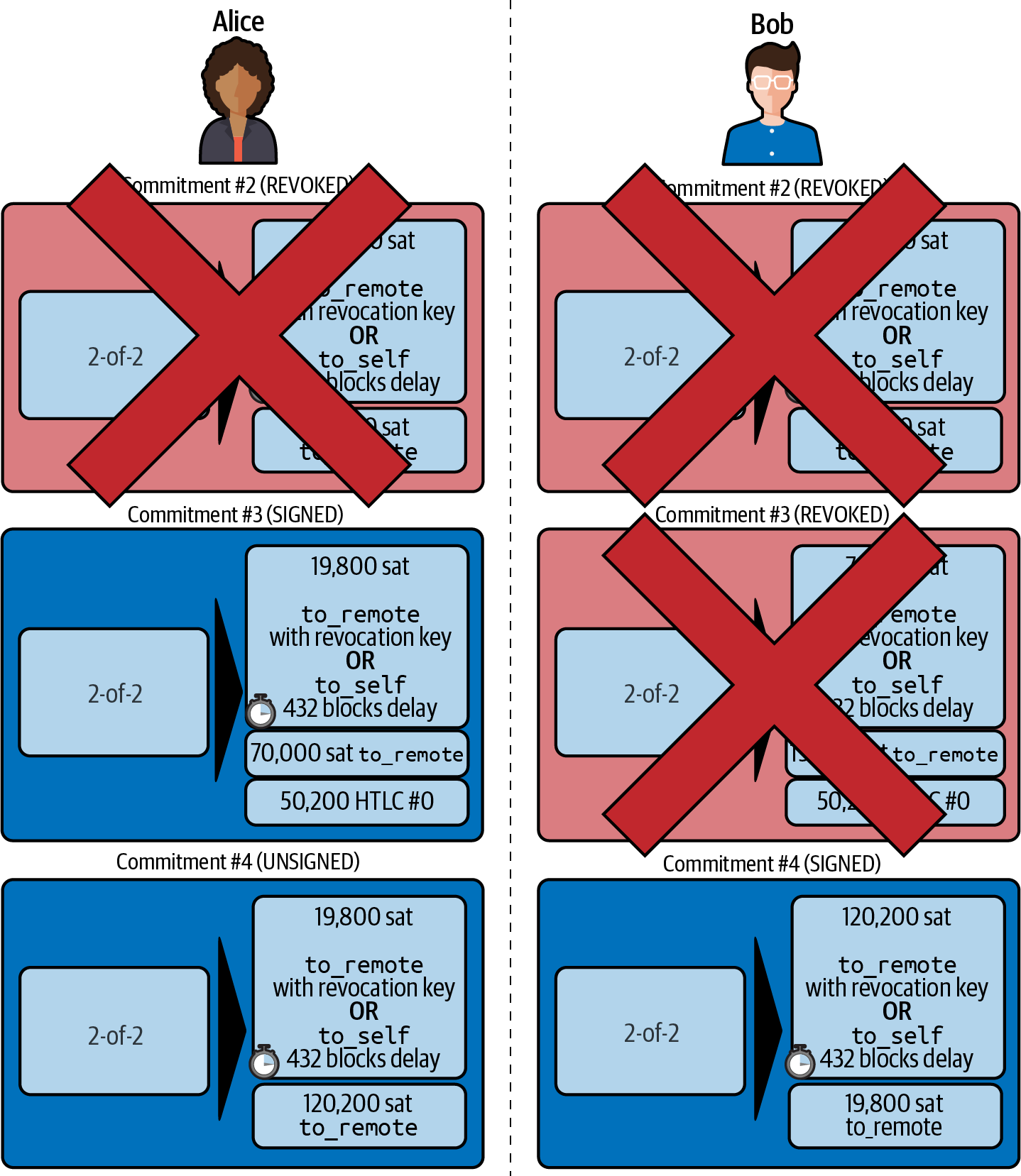

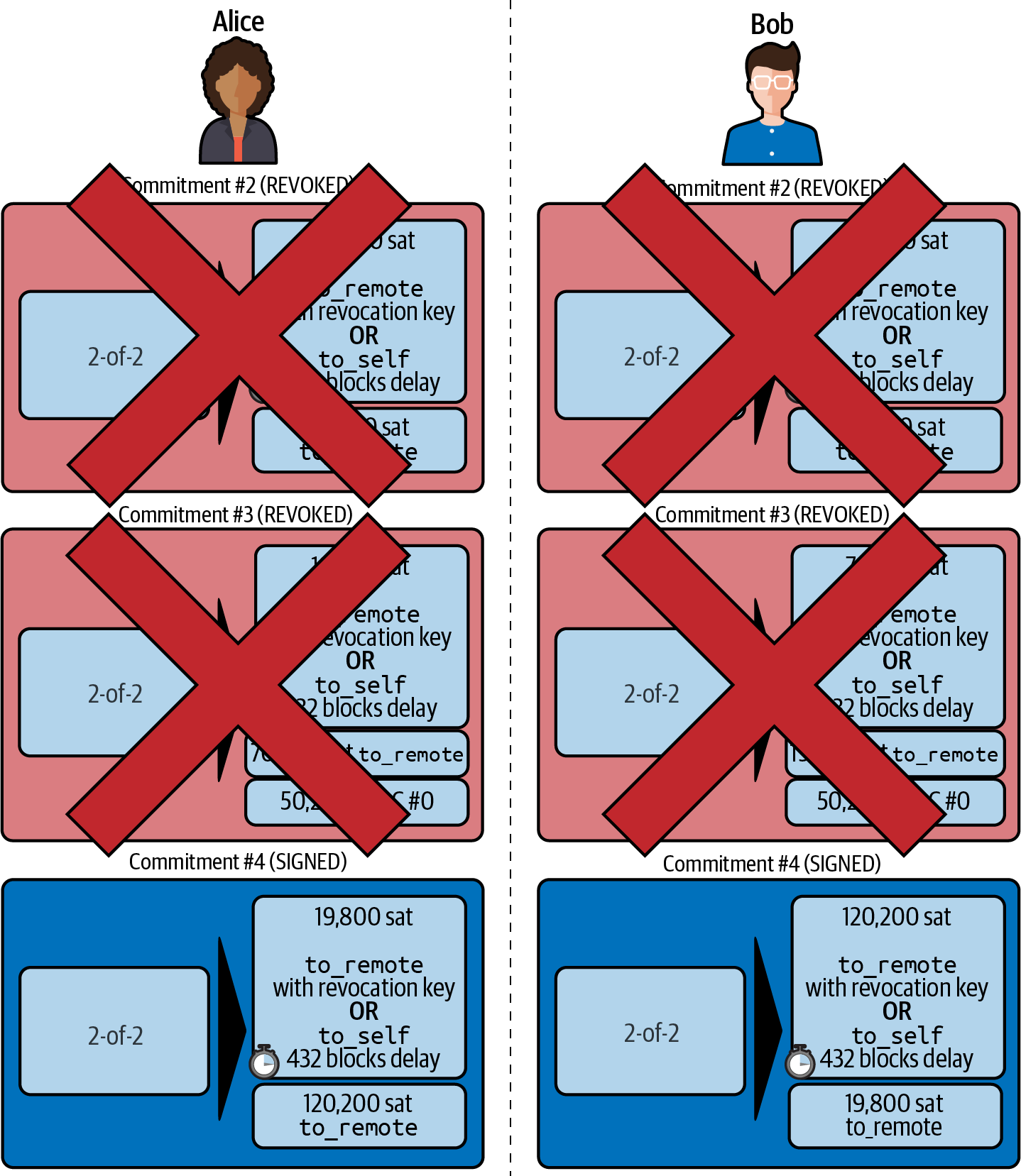

Whenever a channel is moved to a new state, the old state is "revoked" by ensuring that if anyone tries to broadcast it, they lose the entire balance and get punished.

-

Those who forward payments know that if they commit funds forward, they can either get a refund or get paid by the node preceding them.

Again and again, we see this pattern. Fair outcomes are not enforced by any authority. They emerge as the natural consequence of a protocol that rewards fairness and punishes cheating, a fairness protocol that harnesses self-interest by directing it toward fair outcomes.

Bitcoin and the Lightning Network are both implementations of fairness protocols. So why do we need the Lightning Network? Isn’t Bitcoin enough?

Motivation for the Lightning Network

Bitcoin is a system that records transactions on a globally replicated public ledger. Every transaction is seen, validated, and stored by every participating computer. As you can imagine, this generates a lot of data and is difficult to scale.

As Bitcoin and the demand for transactions grew, the number of transactions in each block increased until it eventually reached the block size limit. Once blocks are "full," excess transactions are left to wait in a queue. Many users will increase the fees they’re willing to pay to buy space for their transactions in the next block.

If demand continues to outpace the capacity of the network, an increasing number of users' transactions are left waiting unconfirmed. Competition for fees also increases the cost of each transaction, making many smaller-value transactions (e.g., microtransactions) completely uneconomical during periods of particularly high demand.

To solve this problem, we could increase the block size limit to create space for more transactions. An increase in the "supply" of block space will lead to a lower price equilibrium for transaction fees.

However, increasing block size shifts the cost to node operators and requires them to expend more resources to validate and store the blockchain. Because blockchains are gossip protocols, each node is required to know and validate every single transaction that occurs on the network. Furthermore, once validated, each transaction and block must be propagated to the node’s "neighbors," multiplying the bandwidth requirements. As such, the greater the block size, the greater the bandwidth, processing, and storage requirements for each individual node. Increasing transaction capacity in this way has the undesirable effect of centralizing the system by reducing the number of nodes and node operators. Since node operators are not compensated for running nodes, if nodes are very expensive to run, only a few well-funded node operators will continue to run nodes.

Scaling Blockchains

The side effects of increasing the block size or decreasing the block time with respect to centralization of the network are severe, as a few calculations with the numbers show.

Let us assume the usage of Bitcoin grows so that the network has to process 40,000 transactions per second, which is the approximate transaction processing level of the Visa network during peak usage.

Assuming 250 bytes on average per transaction, this would result in a data stream of 10 megabytes per second (MBps) or 80 megabits per second (Mbps) just to be able to receive all the transactions. This does not include the traffic overhead of forwarding the transaction information to other peers. While 10 MBps does not seem extreme in the context of high-speed fiber optic and 5G mobile speeds, it would effectively exclude anyone who cannot meet this requirement from running a node, especially in countries where high-performance internet is not affordable or widely available.

Users also have many other demands on their bandwidth and cannot be expected to expend this much only to receive transactions.

Furthermore, storing this information locally would result in 864 gigabytes per day. This is roughly one terabyte of data, or the size of a hard drive.

Verifying 40,000 Elliptic Curve Digital Signature Algorithm (ECDSA) signatures per second is also barely feasible (see this article on StackExchange), making the initial block download (IBD) of the Bitcoin blockchain (synchronizing and verifying everything starting from the genesis block) almost impossible without very expensive hardware.

While 40,000 transactions per second seems like a lot, it only achieves parity with traditional financial payment networks at peak times. Innovations in machine-to-machine payments, microtransactions, and other applications are likely to push demand to many orders higher than that.

Simply put: you can’t scale a blockchain to validate the entire world’s transactions in a decentralized way.

But what if each node wasn’t required to know and validate every single transaction? What if there was a way to have scalable off-chain transactions, without losing the security of the Bitcoin network?

In February 2015, Joseph Poon and Thaddeus Dryja proposed a possible solution to the Bitcoin scalability problem, with the publication of "The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments."[2]

In the (now outdated) whitepaper, Poon and Dryja estimate that in order for Bitcoin to reach the 47,000 transactions per second processed at peak by Visa, it would require 8 GB blocks. This would make running a node completely untenable for anyone but large-scale enterprises and industrial-grade operations. The result would be a network in which only a few users could actually validate the state of the ledger. Bitcoin relies on users validating the ledger for themselves, without explicitly trusting third parties, in order to stay decentralized. Pricing users out of running nodes would force the average user to trust third parties to discover the state of the ledger, ultimately breaking the trust model of Bitcoin.

The Lightning Network proposes a new network, a second layer, where users can make payments to each other peer-to-peer, without the necessity of publishing a transaction to the Bitcoin blockchain for each payment. Users may pay each other on the Lightning Network as many times as they want, without creating additional Bitcoin transactions or incurring on-chain fees. They only make use of the Bitcoin blockchain to load bitcoin onto the Lightning Network initially and to settle, that is, to remove bitcoin from the Lightning Network. The result is that many more Bitcoin payments can take place off-chain, with only the initial loading and final settlement transactions needing to be validated and stored by Bitcoin nodes. Aside from reducing the burden on nodes, payments on the Lightning Network are cheaper for users because they do not need to pay blockchain fees, and more private for users because they are not published to all participants of the network and furthermore are not stored permanently.

While the Lightning Network was initially conceived for Bitcoin, it can be implemented on any blockchain that meets some basic technical requirements. Other blockchains, such as Litecoin, already support the Lightning Network. Additionally, several other blockchains are developing similar second layer or "layer 2" solutions to help them scale.

The Lightning Network’s Defining Features

The Lightning Network is a network that operates as a second layer protocol on top of Bitcoin and other blockchains. The Lightning Network enables fast, secure, private, trustless, and permissionless payments. Here are some of the features of the Lightning Network:

-

Users of the Lightning Network can route payments to each other for low cost and in real time.

-

Users who exchange value over the Lightning Network do not need to wait for block confirmations for payments.

-

Once a payment on the Lightning Network has completed, usually within a few seconds, it is final and cannot be reversed. Like a Bitcoin transaction, a payment on the Lightning Network can only be refunded by the recipient.

-

Whereas on-chain Bitcoin transactions are broadcast and verified by all nodes in the network, payments routed on the Lightning Network are transmitted between pairs of nodes and are not visible to everyone, resulting in much greater privacy.

-

Unlike transactions on the Bitcoin network, payments routed on the Lightning Network do not need to be stored permanently. Lightning thus uses fewer resources and hence is cheaper. This property also has benefits for privacy.

-

The Lightning Network uses onion routing, similar to the protocol used by The Onion Router (Tor) privacy network, so that even the nodes involved in routing a payment are only directly aware of their predecessor and successor in the payment route.

-

When used on top of Bitcoin, the Lightning Network uses real bitcoin, which is always in the possession (custody) and full control of the user. Lightning is not a separate token or coin, it is Bitcoin.

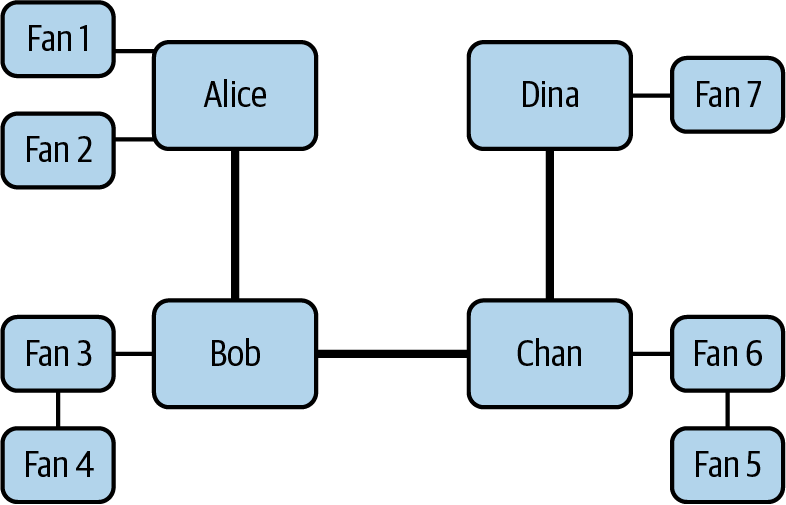

Lightning Network Use Cases, Users, and Their Stories

To better understand how the Lightning Network actually works, and why people use it, we’ll be following a number of users and their stories.

In our examples, some of the people have already used Bitcoin and others are completely new to the Bitcoin network. Each person and their story, as listed here, illustrate one or more specific use cases. We’ll be revisiting them throughout this book:

- Consumer

-

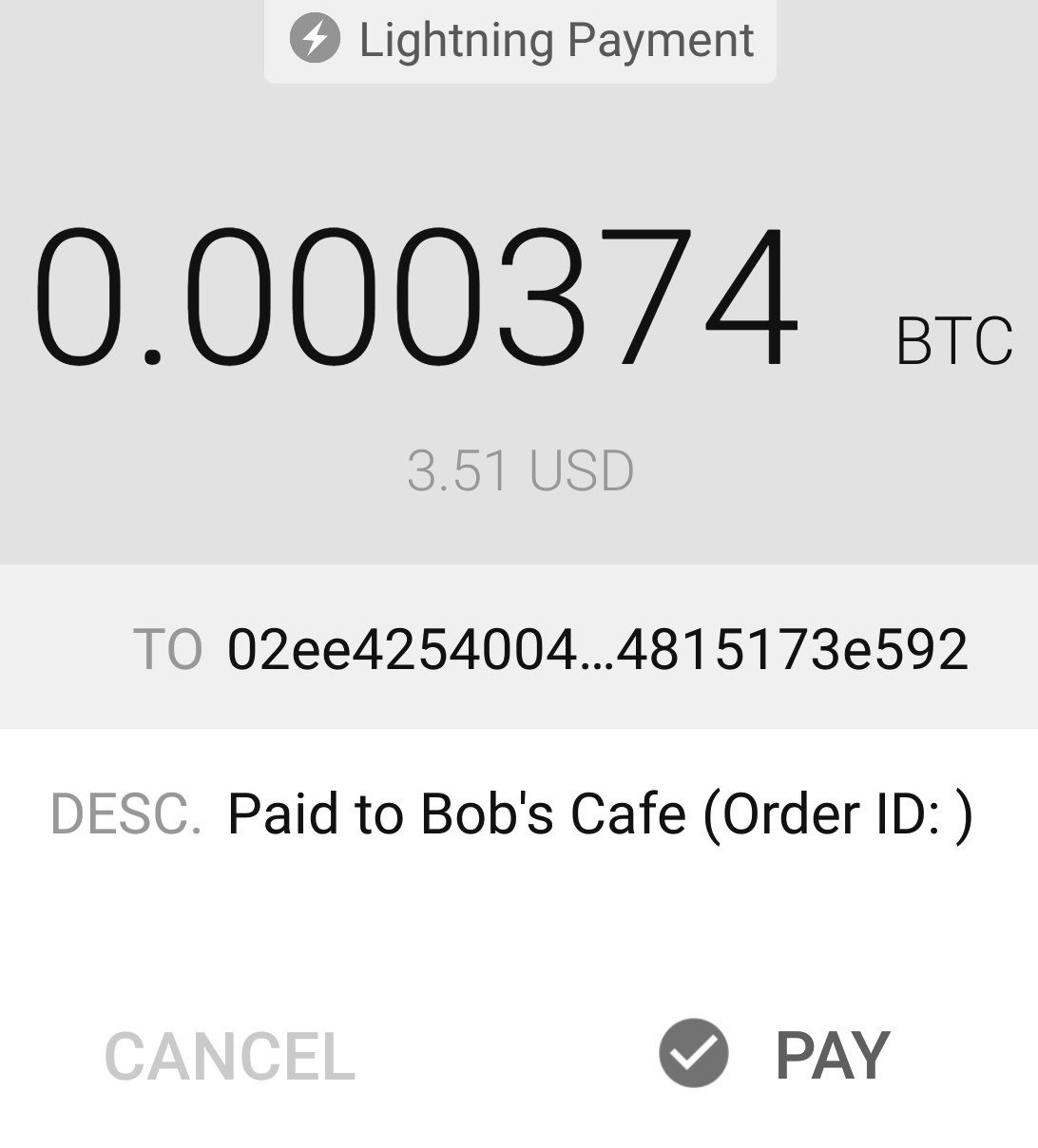

Alice is a Bitcoin user who wants to make fast, secure, cheap, and private payments for small retail purchases. She buys coffee with bitcoin, using the Lightning Network.

- Merchant

-

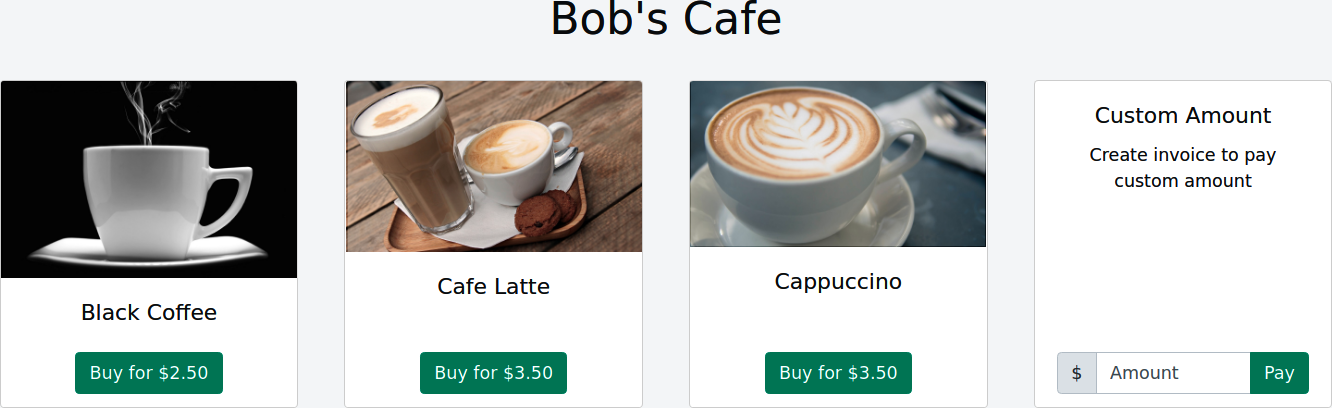

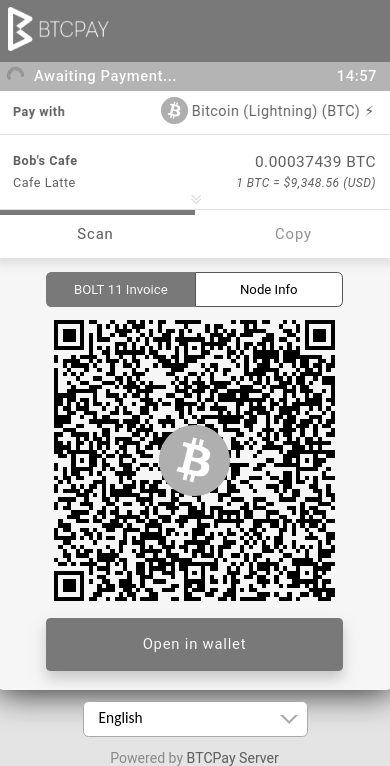

Bob owns a coffee shop, "Bob’s Cafe." On-chain Bitcoin payments don’t scale for small amounts like a cup of coffee, so he uses the Lightning Network to accept Bitcoin payments almost instantaneously and for low fees.

- Software service business

-

Chan is a Chinese entrepreneur who sells information services related to the Lightning Network, as well as Bitcoin and other cryptocurrencies. Chan is selling these information services over the internet by implementing micropayments over the Lightning Network. Additionally, Chan has implemented a liquidity provider service that rents inbound channel capacity on the Lightning Network, charging a small bitcoin fee for each rental period.

- Gamer

-

Dina is a teenage gamer from Russia. She plays many different computer games, but her favorite ones are those that have an "in-game economy" based on real money. As she plays games, she also earns money by acquiring and selling virtual in-game items. The Lightning Network allows her to transact in small amounts for in-game items as well as earn small amounts for completing quests.

Conclusion

In this chapter, we talked about the fundamental concept that underlies both Bitcoin and the Lightning Network: the fairness protocol.

We looked at the history of the Lightning Network and the motivations behind second layer scaling solutions for Bitcoin and other blockchain-based networks.

We learned basic terminology including node, payment channel, on-chain transactions, and off-chain payments.

Finally, we met Alice, Bob, Chan, and Dina, whom we’ll be following throughout the rest of the book. In the next chapter, we’ll meet Alice and walk through her thought process as she selects a Lightning wallet and prepares to make her first Lightning payment to buy a cup of coffee from Bob’s Cafe.

02 Getting Started

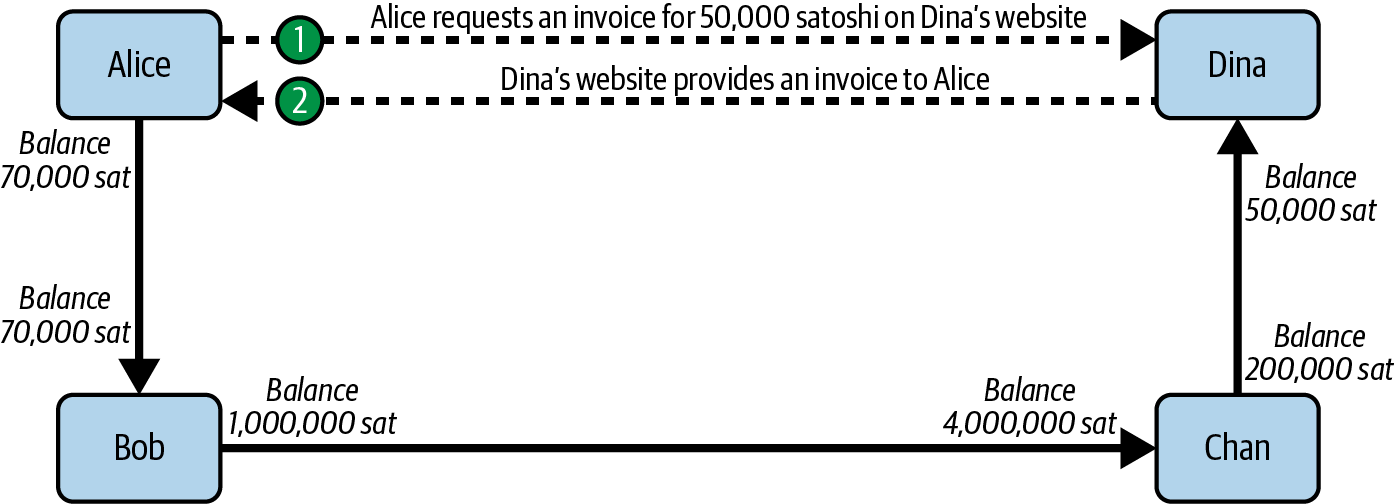

In this chapter, we will begin where most people start when encountering the Lightning Network for the first time—choosing software to participate in the LN economy. We will examine the choices of two users who represent a common use case for the Lightning Network and learn by example. Alice, a coffee shop customer, will be using a Lightning wallet on her mobile device to buy coffee from Bob’s Cafe. Bob, a merchant, will be using a Lightning node and wallet to run a point-of-sale system at his cafe, so he can accept payments over the Lightning Network.

Alice’s First Lightning Wallet

Alice is a longtime Bitcoin user. We first met Alice in Chapter 1 of Mastering Bitcoin,[3] when she bought a cup of coffee from Bob’s cafe using a Bitcoin transaction. If you are not yet familiar with how Bitcoin transactions work or need a refresher, please read Mastering Bitcoin or the summary in Bitcoin Fundamentals Review.

Alice recently learned that Bob’s Cafe just started accepting LN payments! Alice is eager to learn about and experiment with the Lightning Network; she wants to be one of Bob’s first LN customers. To do this, first, Alice has to select a Lightning wallet that meets her needs.

Alice does not want to entrust custody of her bitcoin to third parties. She has learned enough about cryptocurrency to know how to use a wallet. She also wants a mobile wallet so that she can use it for small payments on the go, so she chooses the Eclair wallet, a popular noncustodial mobile Lightning wallet. Let’s learn more about how and why she’s made these choices.

Lightning Nodes

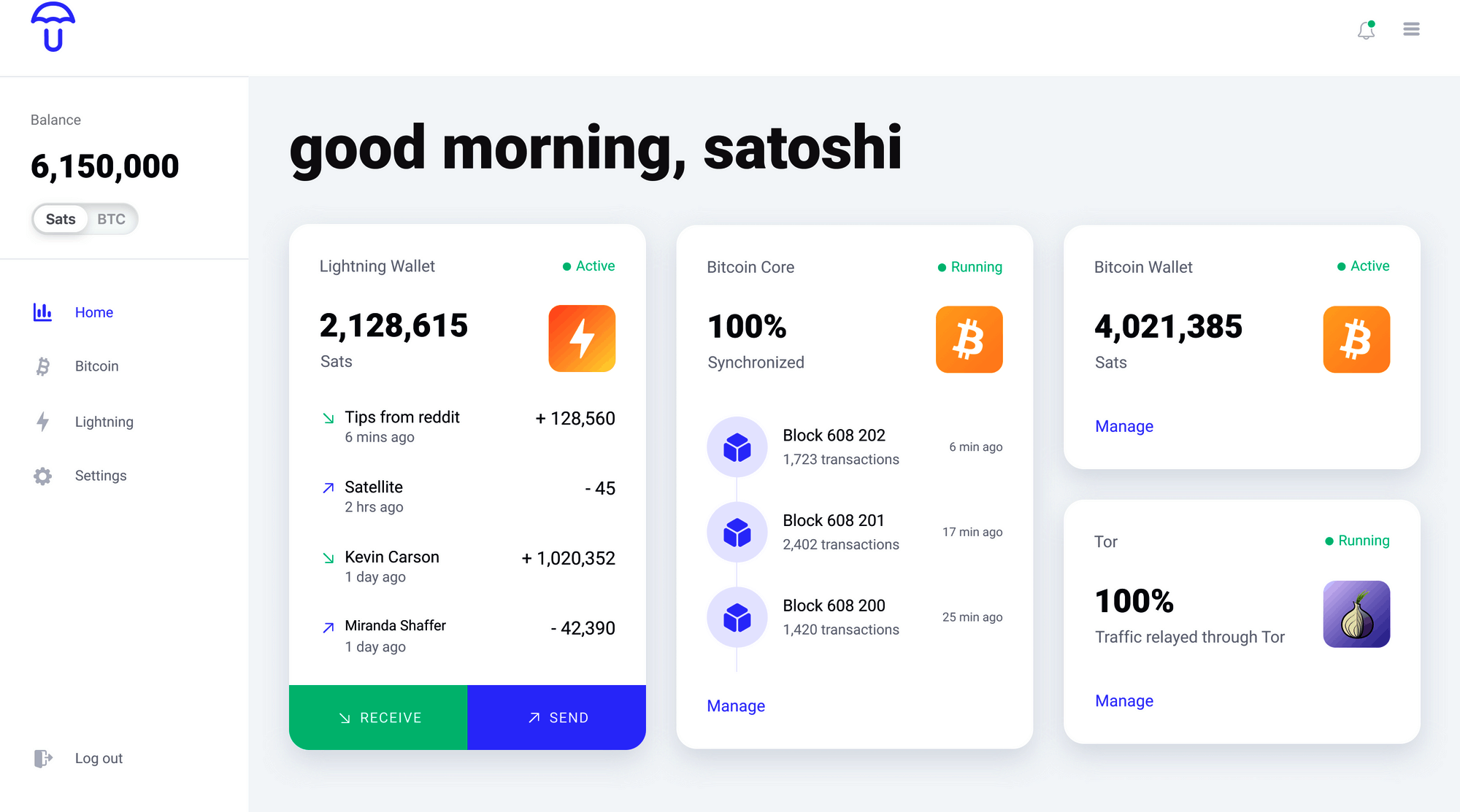

The Lightning Network is accessed via software applications that can speak the LN protocol. A Lightning Network node (LN node or simply node) is a software application that has three important characteristics. First, Lightning nodes are wallets, so they send and receive payments over the Lightning Network as well as on the Bitcoin network. Second, nodes must communicate on a peer-to-peer basis with other Lightning nodes creating the network. Finally, Lightning nodes also need access to the Bitcoin blockchain (or other blockchains for other cryptocurrencies) to secure the funds used for payments.

Users have the highest degree of control by running their own Bitcoin node and Lightning node. However, Lightning nodes can also use a lightweight Bitcoin client, commonly referred to as simplified payment verification (SPV), to interact with the Bitcoin blockchain.

Lightning Explorers

LN explorers are useful tools to show the statistics of nodes, channels, and network capacity.

Following is an inexhaustive list:

-

ACINQ’s Lightning explorer, with fancy visualization

-

Amboss Space Lightning explorer, with community metrics and intuitive visualizations

-

Fiatjaf’s Lightning explorer with many diagrams

|

Note that when using Lightning explorers, just like with other block explorers, privacy can be a concern. If users are careless, the website may track their IP addresses and collect their behavior records (for example, the nodes users are interested in). Also, it should be noted that because there is no global consensus of the current Lightning graph or the current state of any existing channel policy, users should never rely on Lightning explorers to retrieve the most current information. Furthermore, as users open, close, and update channels, the graph will change and individual Lightning explorers may not be up to date. Use Lightning explorers to visualize the network or gather information, but not as an authoritative source of what is happening on the Lightning Network. To have an authoritative view of the Lightning Network, run your own Lightning node that will build a channel graph and collect various statistics, which you can view with a web-based interface. |

Lightning Wallets

The term Lightning wallet is somewhat ambiguous because it can describe a broad variety of components combined with some user interface. The most common components of Lightning wallet software include:

-

A keystore that holds secrets, such as private keys

-

An LN node (Lightning node) that communicates on the peer-to-peer network, as described previously

-

A Bitcoin node that stores blockchain data and communicates with other Bitcoin nodes

-

A database "map" of nodes and channels that are announced on the Lightning Network

-

A channel manager that can open and close LN channels

-

A close-up system that can find a path of connected channels from payment source to payment destination

A Lightning wallet may contain all of these functions, acting as a "full" wallet, with no reliance on any third-party services. Or one or more of these components may rely (partially or entirely) on third-party services that mediate those functions.

A key distinction (pun intended) is whether the keystore function is internal or outsourced. In blockchains, control of keys determines custody of funds, as memorialized by the phrase "your keys, your coins; not your keys, not your coins." Any wallet that outsources management of keys is called a custodial wallet because a third party acting as custodian has control of the user’s funds, not the user. A noncustodial or self-custody wallet, by comparison, is one where the keystore is part of the wallet, and keys are controlled directly by the user. The term noncustodial wallet just implies that the keystore is local and under the user’s control. However, one or more of the other wallet components may or may not be outsourced and rely on trusted third parties.

Blockchains, especially open blockchains like Bitcoin, attempt to minimize or eliminate trust in third parties and empower users. This is often called a "trustless" model, though "trust minimized" is a better term. In such systems, the user trusts the software rules, not third parties. Therefore, the issue of control over keys is a principal consideration when choosing a Lightning wallet.

Every other component of a Lightning wallet brings similar considerations of trust. If all the components are under the control of the user, then the amount of trust in third parties is minimized, bringing maximum power to the user. Of course, this brings a direct trade-off because with that power comes the corresponding responsibility to manage complex software.

Every user must consider their own technical skills before deciding what type of Lightning wallet to use. Those with strong technical skills should use a Lightning wallet that puts all of the components under the direct control of the user. Those with fewer technical skills, but with a desire to control their funds, should choose a noncustodial Lightning wallet. Often the trust in these cases relates to privacy. If users decide to outsource some functionality to a third party, they usually give up some privacy as the third party will learn some information about them.

Finally, those seeking simplicity and convenience, even at the expense of control and security, may choose a custodial Lightning wallet. This is the least technically challenging option, but it undermines the trust model of cryptocurrency and should therefore be considered only as a stepping stone toward more control and self-reliance.

There are many ways wallets can be characterized or categorized. The most important questions to ask about a specific wallet are:

-

Does this Lightning wallet have a full Lightning node or does it use a third-party Lightning node?

-

Does this Lightning wallet have a full Bitcoin node or does it use a third-party Bitcoin node?

-

Does this Lightning wallet store its own keys under user control (self-custody) or are the keys held by a third-party custodian?

|

If a Lightning wallet uses a third-party Lightning node, it is this third-party Lightning node that decides how to communicate with Bitcoin. Hence, using a third-party Lightning node implies that you are also using a third-party Bitcoin node. Only when the Lightning wallet uses its own Lightning node does the choice between full Bitcoin node and third-party Bitcoin node exist. |

At the highest level of abstraction, Questions 1 and 3 are the most elementary ones. From these two questions, we can derive four possible categories. We can place these four categories into a quadrant, as seen in Lightning wallets quadrant. But remember that this is just one way of categorizing Lightning wallets.

| Full Lightning node | Third-party Lightning node | |

|---|---|---|

Self-custody |

Q1: High technical skill, least trust in third parties, most permissionless |

Q2: Below medium technical skills, below medium trust in third parties, requires some permissions |

Custodial |

Q3: Above medium technical skills, above medium trust in third parties, requires some permissions |

Q4: Low technical skills, high trust in third parties, least permissionless |

Quadrant 3 (Q3), where a full Lightning node is used, but the keys are held by a custodian, is currently not common. Future wallets from that quadrant may let a user worry about the operational aspects of their node, but then delegate access to the keys to a third party which primarily uses cold storage.

Lightning wallets can be installed on a variety of devices, including laptops, servers, and mobile devices. To run a full Lightning node, you will need to use a server or desktop computer, because mobile devices and laptops are usually not powerful enough in terms of capacity, processing, battery life, and connectivity.

The category third-party Lightning nodes can again be subdivided:

- Lightweight

-

This means that the wallet does not operate a Lightning node and thus needs to obtain information about the Lightning Network over the internet from someone else’s Lightning node.

- None

-

This means that not only is the Lightning node operated by a third party, but most of the wallet is operated by a third party in the cloud. This is a custodial wallet where someone else controls custody of the funds.

These subcategories are used in Examples of popular Lightning wallets.

Other terms that need explanation in Examples of popular Lightning wallets in the column "Bitcoin node" are:

- Neutrino

-

This wallet does not operate a Bitcoin node. Instead, a Bitcoin node operated by someone else (a third party) is accessed via the Neutrino Protocol.

- Electrum

-

This wallet does not operate a Bitcoin node. Instead, a Bitcoin node operated by someone else (a third party) is accessed via the Electrum Protocol.

- Bitcoin Core

-

This is an implementation of a Bitcoin node.

- btcd

-

This is another implementation of a Bitcoin node.

In Examples of popular Lightning wallets, we see some examples of currently popular Lightning node and wallet applications for different types of devices. The list is sorted first by device type and then alphabetically.

| Application | Device | Lightning node | Bitcoin node | Keystore |

|---|---|---|---|---|

Blue Wallet |

Mobile |

None |

None |

Custodial |

Breez Wallet |

Mobile |

Full node |

Neutrino |

Self-custody |

Eclair Mobile |

Mobile |

Lightweight |

Electrum |

Self-custody |

lntxbot |

Mobile |

None |

None |

Custodial |

Muun |

Mobile |

Lightweight |

Neutrino |

Self-custody |

Phoenix Wallet |

Mobile |

Lightweight |

Electrum |

Self-custody |

Zeus |

Mobile |

Full node |

Bitcoin Core/btcd |

Self-custody |

Electrum |

Desktop |

Full node |

Bitcoin Core/Electrum |

Self-custody |

Zap Desktop |

Desktop |

Full node |

Neutrino |

Self-custody |

c-lightning |

Server |

Full node |

Bitcoin Core |

Self-custody |

Eclair Server |

Server |

Full node |

Bitcoin Core/Electrum |

Self-custody |

lnd |

Server |

Full node |

Bitcoin Core/btcd |

Self-custody |

Testnet Bitcoin

The Bitcoin system offers an alternative chain for testing purposes called testnet, in contrast with the "normal" Bitcoin chain which is referred to as mainnet. On testnet, the currency is testnet bitcoin (tBTC), which is a worthless copy of bitcoin used exclusively for testing. Every function of Bitcoin is replicated exactly, but the money is worth nothing, so you literally have nothing to lose!

Some Lightning wallets can also operate on testnet, allowing you to make Lightning payments with testnet bitcoin, without risking real funds. This is a great way to experiment with Lightning safely. Eclair Mobile, which Alice uses in this chapter, is one example of a Lightning wallet that supports testnet operation.

You can get some tBTC to play with from a testnet bitcoin faucet, which gives out free tBTC on demand. Here are a few testnet faucets:

- https://coinfaucet.eu/en/btc-testnet

- https://testnet-faucet.mempool.co

- https://bitcoinfaucet.uo1.net

- https://testnet.help/en/btcfaucet/testnet

All of the examples in this book can be replicated exactly on testnet with tBTC, so you can follow along if you want without risking real money.

Balancing Complexity and Control

Lightning wallets have to strike a careful balance between complexity and user control. Those that give the user the most control over their funds, the highest degree of privacy, and the greatest independence from third-party services are necessarily more complex and difficult to operate. As the technology advances, some of these trade-offs will become less stark, and users may be able to get more control without more complexity. However, for now, different companies and projects are exploring different positions along this control-complexity spectrum, hoping to find the "sweet spot" for the users they are targeting.

When selecting a wallet, keep in mind that even if you don’t see these trade-offs, they still exist. For example, many wallets will attempt to remove the burden of channel management from their users. To do so, they introduce central hub nodes that all their wallets connect to automatically. While this trade-off simplifies the user interface and user experience, it introduces a single point of failure (SPoF) as these hub nodes become indispensable for the wallet’s operation. Furthermore, relying on a "hub" like this can reduce user privacy since the hub knows the sender and potentially (if constructing the payment route on behalf of the user) also the recipient of each payment made by the user’s wallet.

In the next section, we will return to our first user and walk through her first Lightning wallet setup. She has chosen a wallet that is more sophisticated than the easier custodial wallets. This allows us to show some of the underlying complexity and introduce some of the inner workings of an advanced wallet. You may find that your first ideal wallet is oriented toward ease of use, accepting some of the control and privacy trade-offs. Or perhaps you are more of a power user and want to run your own Lightning and Bitcoin nodes as part of your wallet solution.

Downloading and Installing a Lightning Wallet

When looking for a new cryptocurrency wallet, you must be very careful to select a secure source for the software.

Unfortunately, many fake wallet applications will steal your money, and some of these even find their way onto reputable and supposedly vetted software sites like the Apple and Google application stores. Whether you are installing your first or your tenth wallet, always exercise extreme caution. A rogue app may not just steal any money you entrust it with, but it might also be able to steal keys and passwords from other applications by compromising your mobile device operating system.

Alice uses an Android device and will use the Google Play Store to download and install the Eclair wallet. Searching on Google Play, she finds an entry for "Eclair Mobile," as shown in Eclair Mobile in the Google Play Store.

|

It is possible to experiment and test all Bitcoin-type software with zero risk (except for your own time) by using testnet bitcoins. You can also download the Eclair testnet wallet to try Lightning (on testnet) by going to the Google Play Store. |

Alice notices a few different elements on this page that help her ascertain that this is, most likely, the correct "Eclair Mobile" wallet she is looking for. Firstly, the organization ACINQ[4] is listed as the developer of this mobile wallet, which Alice knows from her research is the correct developer. Secondly, the wallet has been installed "10,000+" times and has more than 320 positive reviews. It is unlikely that this is a rogue app that has snuck into the Google Play Store. As a third step, she goes to the ACINQ website. She verifies that the web page is secure by checking that the address begins with https, or prefixed by a padlock in some browsers. On the website, she goes to the Download section or looks for the link to the Google App Store. She finds the link and clicks it. She compares that this link brings her to the very same app in the Google App Store. Satisfied by these findings, Alice installs the Eclair app on her mobile device.

|

Always exercise great care when installing software on any device. There are many fake cryptocurrency wallets that will not only steal your money but might also compromise all other applications on your device. |

Creating a New Wallet

When Alice opens the Eclair Mobile app for the first time, she is presented with a choice to "Create a New Wallet" or to "Import an Existing Wallet." Alice will create a new wallet, but let’s first discuss why these options are presented here and what it means to import an existing wallet.

Responsibility with Key Custody

As we mentioned at the beginning of this section, Eclair is a noncustodial wallet, meaning that Alice has sole custody of the keys used to control her bitcoin. This also means that Alice is responsible for protecting and backing up those keys. If Alice loses the keys, no one can help her recover the bitcoin, and they will be lost forever.

|

With the Eclair Mobile wallet, Alice has custody and control of the keys and, therefore, full responsibility to keep the keys safe and backed up. If she loses the keys, she loses the bitcoin, and no one can help her recover from that loss! |

Mnemonic Words

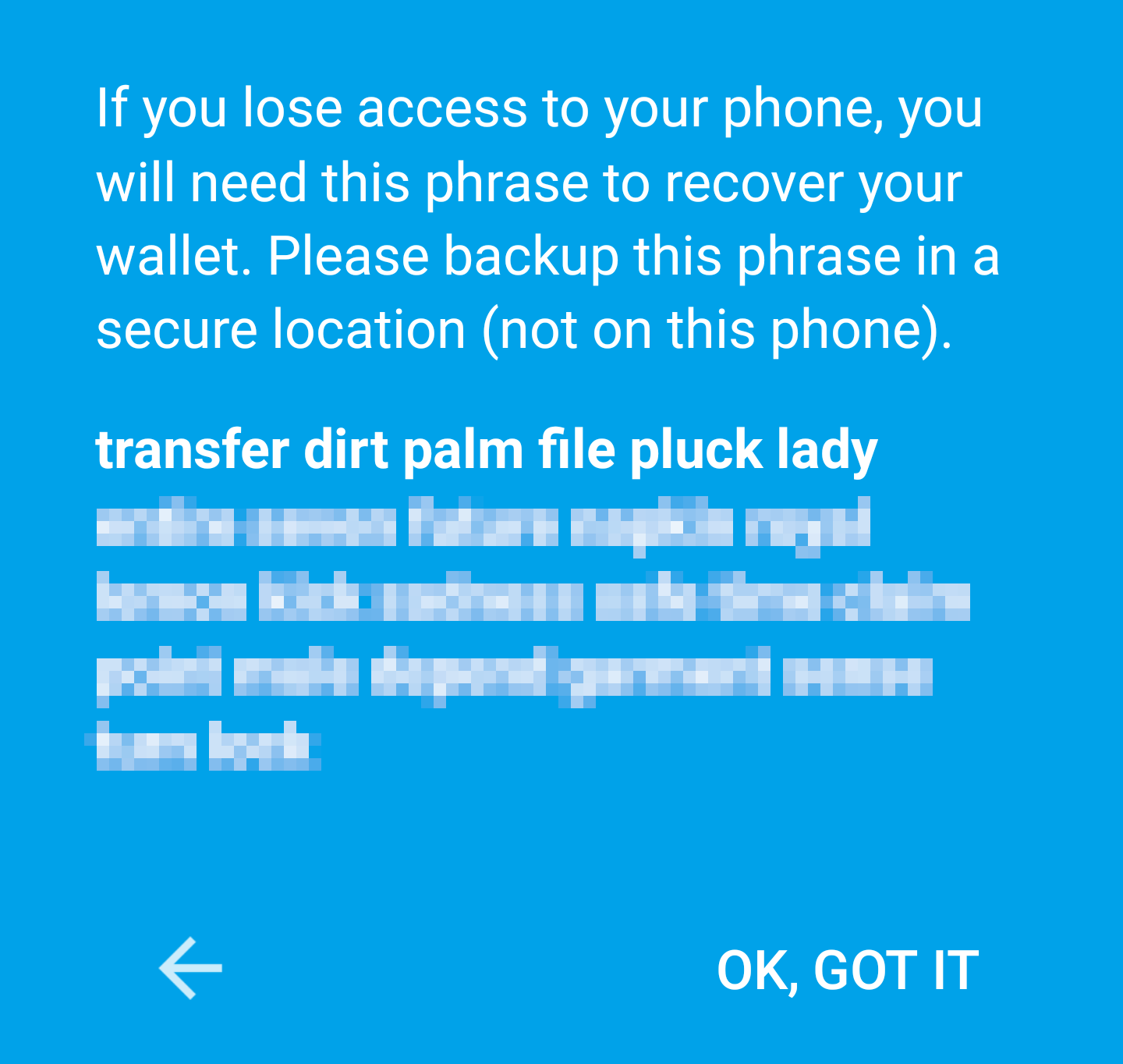

Similar to most Bitcoin wallets, Eclair Mobile provides a mnemonic phrase (also sometimes called a "seed" or "seed phrase") for Alice to back up. The mnemonic phrase consists of 24 English words, selected randomly by the software and used as the basis for the keys that are generated by the wallet. Alice can use the mnemonic phrase to restore all the transactions and funds in the Eclair Mobile wallet in the case of a lost mobile device, a software bug, or memory corruption.

|

The correct term for these backup words is "mnemonic phrase." We avoid the use of the term "seed" to refer to a mnemonic phrase because even though its use is common, it is incorrect. |

When Alice chooses to create a new wallet, she will see a screen with her mnemonic phrase, which looks like the screenshot in New wallet mnemonic phrase.

In New wallet mnemonic phrase, we have purposely obscured part of the mnemonic phrase to prevent readers of this book from reusing the mnemonic.

Storing the Mnemonic Safely

Alice needs to be careful to store the mnemonic phrase in a way that prevents theft but also avoids accidental loss. The recommended way to properly balance these risks is to write two copies of the mnemonic phrase on paper, with each of the words numbered—the order matters.

Once Alice has recorded the mnemonic phrase, after touching "OK GOT IT" on her screen, she will be presented with a quiz to make sure that she correctly recorded the mnemonic. The quiz will ask for three or four of the words at random. Alice isn’t expecting a quiz, but since she recorded the mnemonic correctly, she passes without any difficulty.

Once Alice has recorded the mnemonic phrase and passed the quiz, she should store each copy in a separate secure location, such as a locked desk drawer or a fireproof safe.

|

Never attempt a "DIY" security scheme that deviates in any way from the best practice recommendation in Storing the Mnemonic Safely. Do not cut your mnemonic in half, make screenshots, store it on USB drives or cloud drives, encrypt it, or try any other nonstandard method. You will tip the balance in such a way as to risk permanent loss. Many people have lost funds, not from theft, but because they tried a nonstandard solution without having the expertise to balance the risks involved. The best practice recommendation is carefully considered by experts and suitable for the vast majority of users. |

After Alice initializes her Eclair Mobile wallet, she will see a brief tutorial that highlights the various elements of the user interface. We won’t replicate the tutorial here, but we will explore all of those elements as we follow Alice’s attempt to buy a cup of coffee!

Loading Bitcoin onto the Wallet

Alice now has a Lightning wallet. But it’s empty! She now faces one of the more challenging aspects of this experiment: she has to find a way to acquire some bitcoin and load it onto her Eclair wallet.

|

If Alice already has bitcoin in another wallet, she could choose to send that bitcoin to her Eclair wallet instead of acquiring new bitcoin to load onto her new wallet. |

Acquiring Bitcoin

There are several ways Alice can acquire bitcoin:

-

She can exchange some of her national currency (e.g., USD) on a cryptocurrency exchange.

-

She can buy some from a friend, or an acquaintance from a Bitcoin meetup, in exchange for cash.

-

She can find a Bitcoin ATM in her area, which acts as a vending machine, selling bitcoin for cash.

-

She can offer her skills or a product she sells and accept payment in bitcoin.

-

She can ask her employer or clients to pay her in bitcoin.

All of these methods have varying degrees of difficulty, and many will involve paying a fee. Some will also require Alice to provide identification documents to comply with local banking regulations. However, with all these methods, Alice will be able to receive bitcoin.

Receiving Bitcoin

Let’s assume Alice has found a local Bitcoin ATM and has decided to buy some bitcoin in exchange for cash. An example of a Bitcoin ATM, one built by the Lamassu Company, is shown in A Lamassu Bitcoin ATM. Such Bitcoin ATMs accept national currency (cash) through a cash slot and send bitcoin to a Bitcoin address scanned from a user’s wallet using a built-in camera.

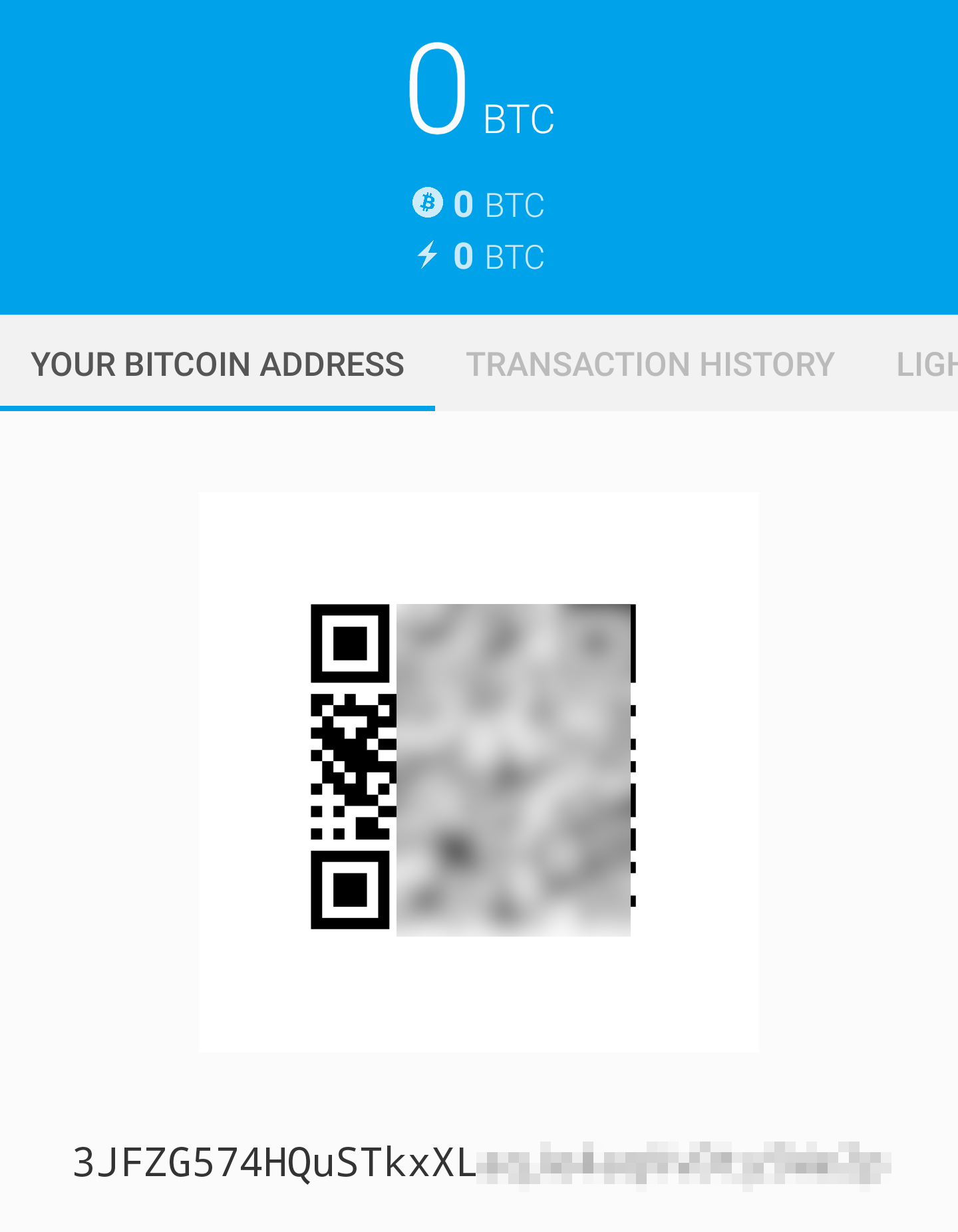

To receive the bitcoin in her Eclair Lightning wallet, Alice will need to present a Bitcoin address from the Eclair Lightning wallet to the ATM. The ATM can then send Alice’s newly acquired bitcoin to this Bitcoin address.

To see a Bitcoin address on the Eclair wallet, Alice must swipe to the left column titled YOUR BITCOIN ADDRESS (see Alice’s bitcoin address, shown in Eclair), where she will see a square barcode (called a QR code) and a string of letters and numbers below that.

The QR code contains the same string of letters and numbers shown below it, in an easy to scan format. This way, Alice doesn’t have to type the Bitcoin address. In the screenshot (Alice’s bitcoin address, shown in Eclair), we have purposely blurred both, to prevent readers from inadvertently sending bitcoin to this address.

|

Both Bitcoin addresses and QR codes contain error detection information that prevents any typing or scanning errors from producing a "wrong" Bitcoin address. If there is a mistake in the address, any Bitcoin wallet will notice the error and refuse to accept the Bitcoin address as valid. |

Alice can take her mobile device to the ATM and show it to the built-in camera, as shown in Bitcoin ATM scans the QR code. After inserting some cash into the slot, she will receive bitcoin in Eclair!

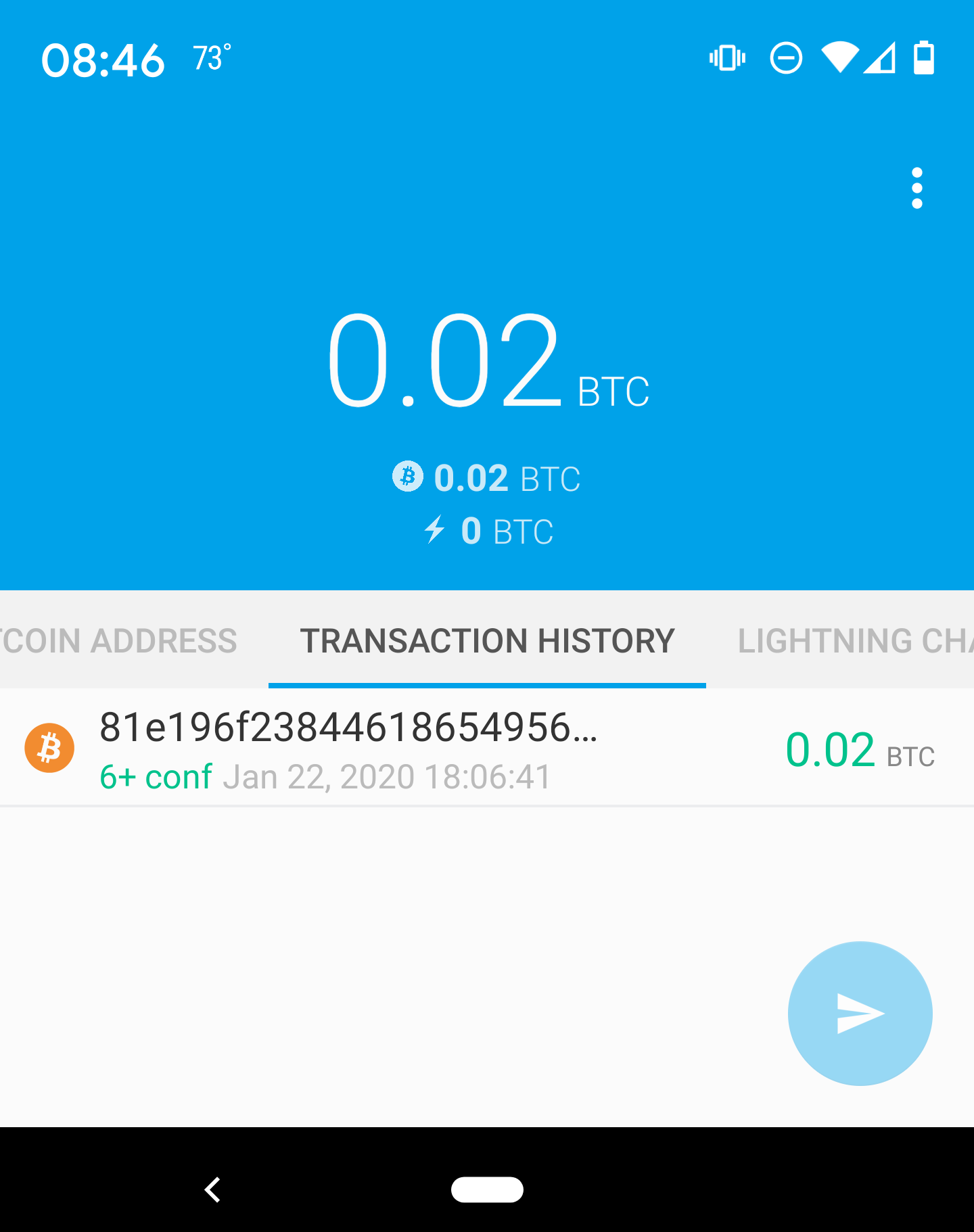

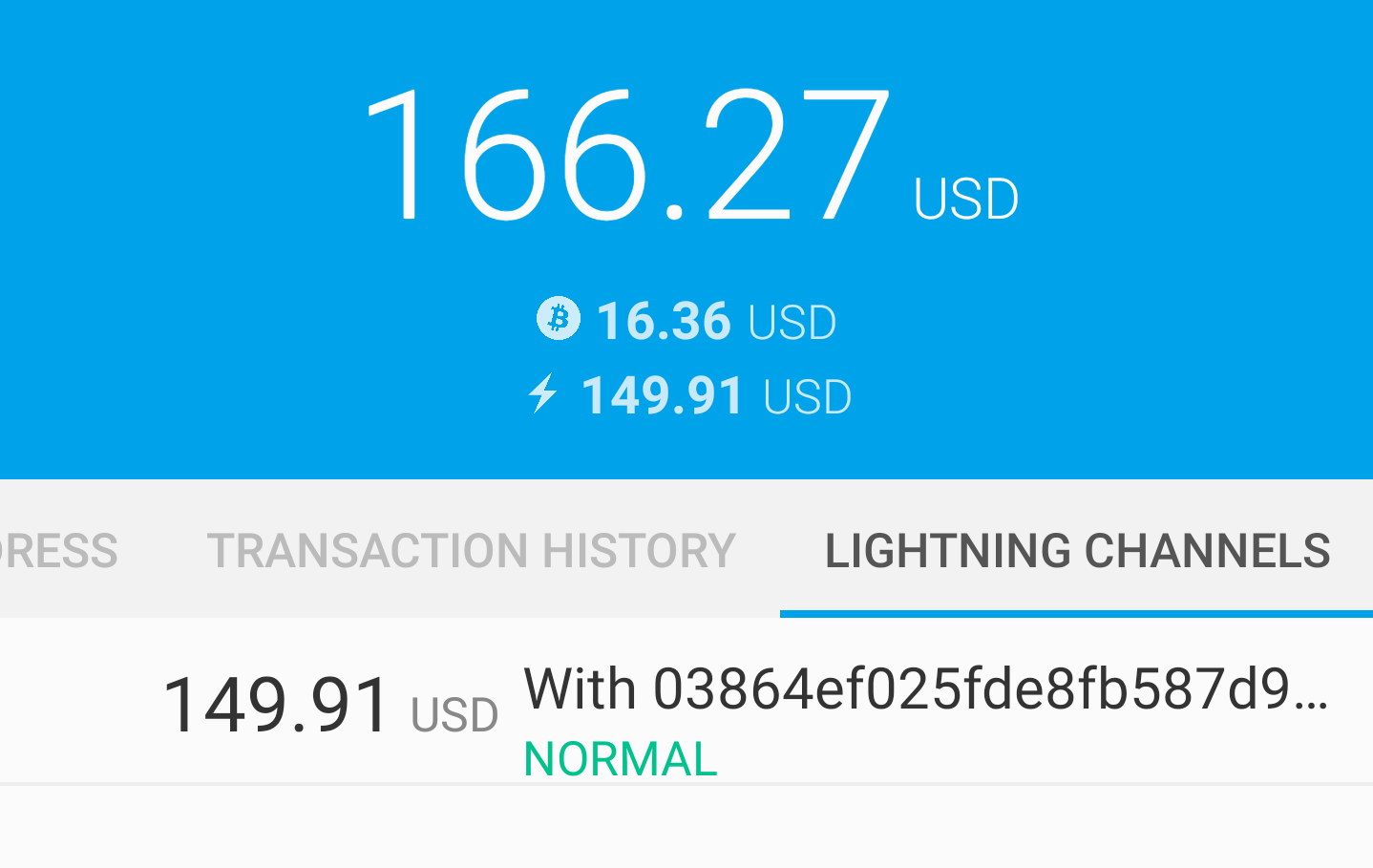

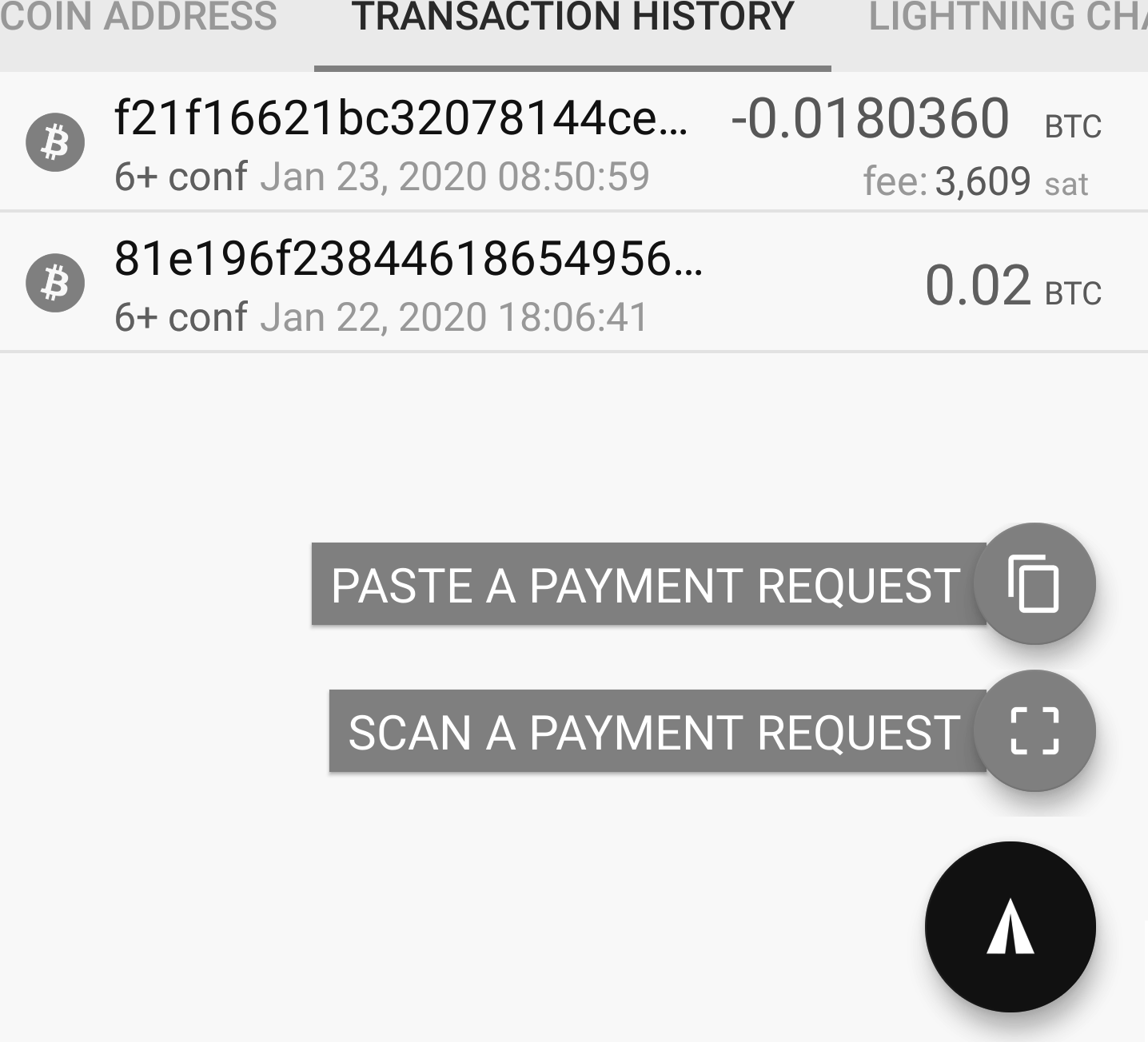

Alice will see the transaction from the ATM in the TRANSACTION HISTORY tab of the Eclair wallet. Although Eclair will detect the bitcoin transaction in just a few seconds, it will take approximately one hour for the bitcoin transaction to be "confirmed" on the Bitcoin blockchain. As you can see in Alice receives bitcoin, Alice’s Eclair wallet shows "6+ conf" below the transaction, indicating that the transaction has received the required minimum of six confirmations, and her funds are now ready to use.

|

The number of confirmations on a transaction is the number of blocks mined since (and inclusive of) the block that contained that transaction. Six confirmations is best practice, but different Lightning wallets can consider a channel open after any number of confirmations. Some wallets even scale up the number of expected confirmations by the monetary value of the channel. |

Although in this example Alice used an ATM to acquire her first bitcoin, the same basic concepts would apply even if she used one of the other methods in Acquiring Bitcoin. For example, if Alice wanted to sell a product or provide a professional service in exchange for bitcoin, her customers could scan the Bitcoin address with their wallets and pay her in bitcoin.

Similarly, if she billed a client for a service offered over the internet, Alice could send an email or instant message with the Bitcoin address or the QR code to her client, and they could paste or scan the information into a Bitcoin wallet to pay her.

Alice could even print the QR code and affix it to a sign and display it publicly to receive tips. For example, she could have a QR code affixed to her guitar and receive tips while performing on the street![5]

Finally, if Alice bought bitcoin from a cryptocurrency exchange, she could (and should) "withdraw" the bitcoin by pasting her Bitcoin address into the exchange website. The exchange will then send the bitcoin to her address directly.

From Bitcoin to Lightning Network

Alice’s bitcoin is now controlled by her Eclair wallet and has been recorded on the Bitcoin blockchain. At this point, Alice’s bitcoin is on-chain, meaning that the transaction has been broadcast to the entire Bitcoin network, verified by all Bitcoin nodes, and mined (recorded) onto the Bitcoin blockchain.

So far, the Eclair Mobile wallet has behaved only as a Bitcoin wallet, and Alice hasn’t used the Lightning Network features of Eclair. As is the case with many Lightning wallets, Eclair bridges Bitcoin and the Lightning Network by acting as both a Bitcoin wallet and a Lightning wallet.

Now, Alice is ready to start using the Lightning Network by taking her bitcoin off-chain to take advantage of the fast, cheap, and private payments that the Lightning Network offers.

Lightning Network Channels

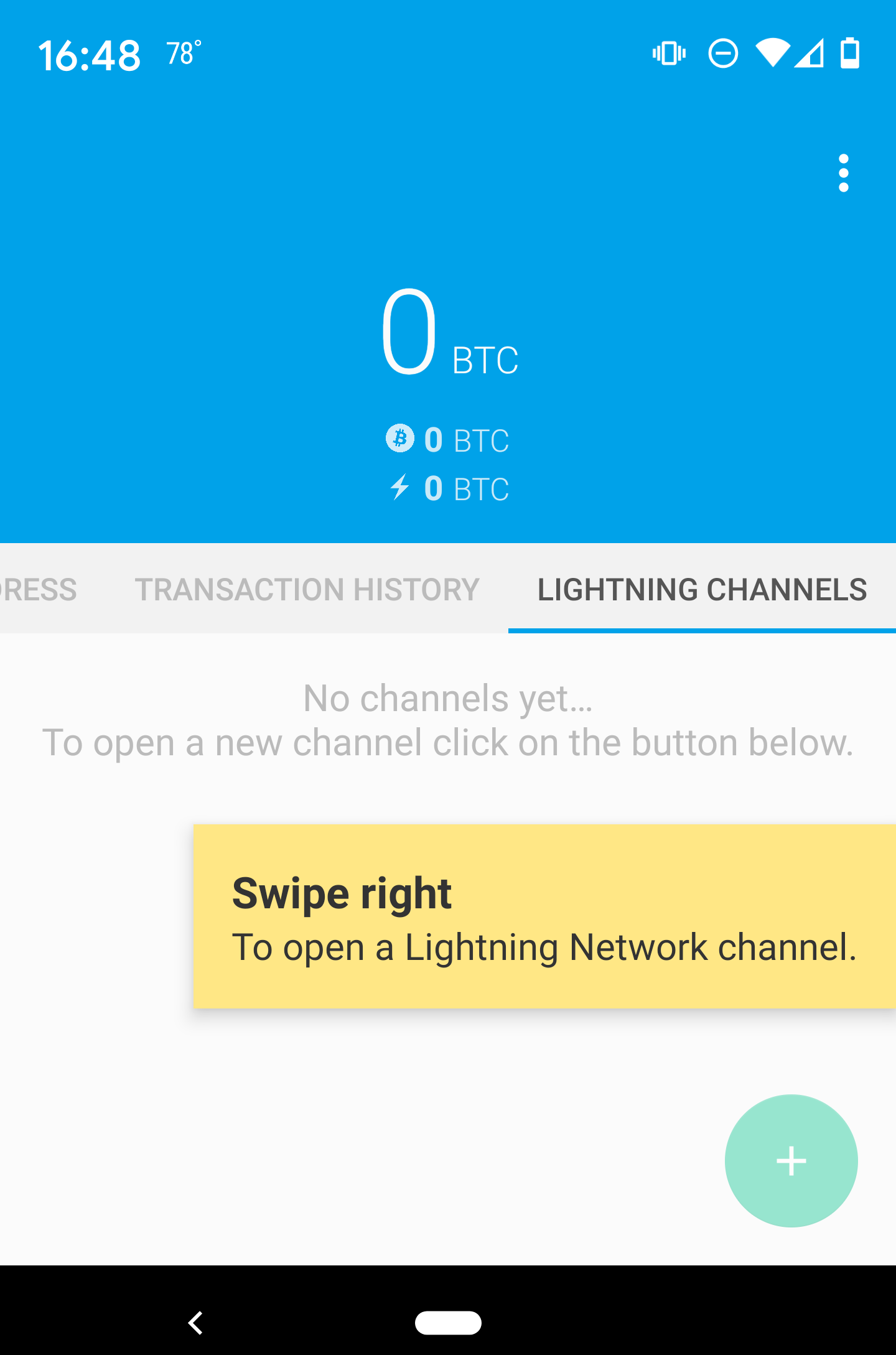

Swiping right, Alice accesses the LIGHTNING CHANNELS section of Eclair. Here she can manage the channels that will connect her wallet to the Lightning Network.

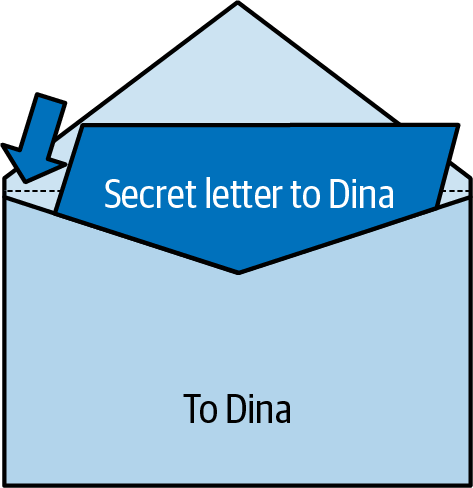

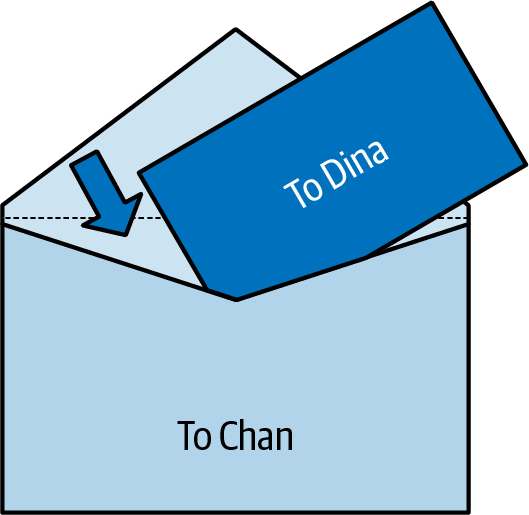

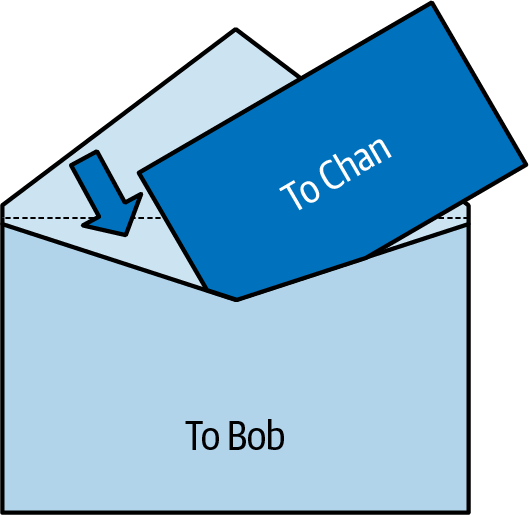

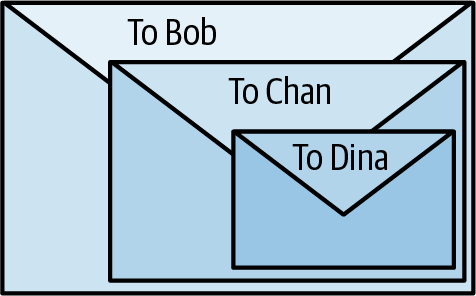

Let’s review the definition of an LN channel at this point, to make things a bit clearer. Firstly, the word "channel" is a metaphor for a financial relationship between Alice’s Lightning wallet and another Lightning wallet. We call it a channel because it is a means for Alice’s wallet and this other wallet to exchange many payments with each other on the Lightning Network (off-chain) without committing transactions to the Bitcoin blockchain (on-chain).

The wallet or node that Alice opens a channel to is called her channel peer. Once "opened," a channel can be used to send many payments back and forth between Alice’s wallet and her channel peer.

Furthermore, Alice’s channel peer can forward payments via other channels further into the Lightning Network. This way, Alice can route a payment to any wallet (e.g., Bob’s Lightning wallet) as long as Alice’s wallet can find a viable path made by hopping from channel to channel, all the way to Bob’s wallet.

|

Not all channel peers are good peers for routing payments. Well-connected peers will be able to route payments over shorter paths to the destination, increasing the chance of success. Channel peers with ample funds will be able to route larger payments. |

In other words, Alice needs one or more channels that connect her to one or more other nodes on the Lightning Network. She doesn’t need a channel to connect her wallet directly to Bob’s Cafe in order to send Bob a payment, though she can choose to open a direct channel, too. Any node in the Lightning Network can be used for Alice’s first channel. The more well-connected a node is, the more people Alice can reach. In this example, since we want to also demonstrate payment routing, we won’t have Alice open a channel directly to Bob’s wallet. Instead, we will have Alice open a channel to a well-connected node and then later use that node to forward her payment, routing it through any other nodes as necessary to reach Bob.

At first, there are no open channels, so as we see in LIGHTNING CHANNELS tab, the LIGHTNING CHANNELS tab displays an empty list. If you notice, in the bottom-right corner there is a plus symbol (+), which is a button to open a new channel.

Alice presses the plus symbol and is presented with four possible ways to open a channel:

-

Paste a node URI

-

Scan a node URI

-

Random node

-

ACINQ node

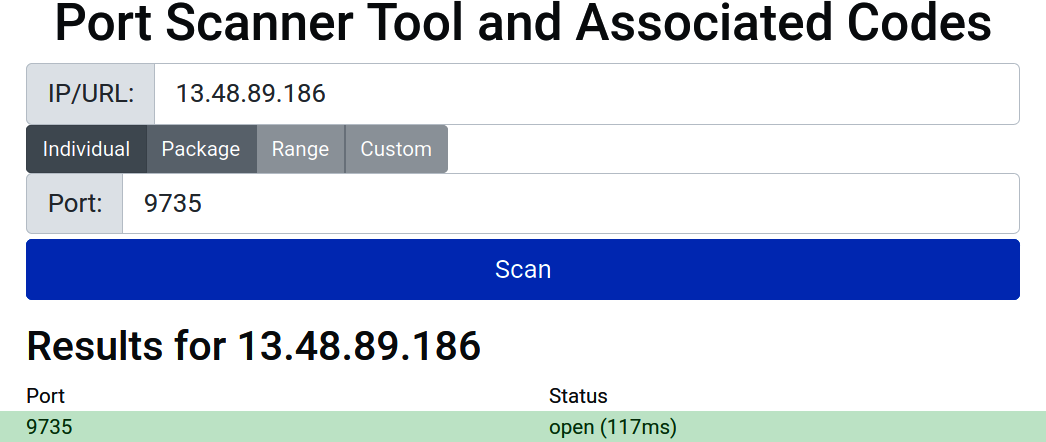

A "node URI" is a Universal Resource Identifier (URI) that identifies a specific Lightning node. Alice can either paste such a URI from her clipboard or scan a QR code containing that same information. An example of a node URI is shown as a QR code in Node URI as a QR code and then as a text string.

0237fefbe8626bf888de0cad8c73630e32746a22a2c4faa91c1d9877a3826e1174@1.ln.aantonop.com:9735

While Alice could select a specific Lightning node, or use the "Random node" option to have the Eclair wallet select a node at random, she will select the ACINQ Node option to connect to one of ACINQ’s well-connected Lightning nodes.

Choosing the ACINQ node will slightly reduce Alice’s privacy, because it will give ACINQ the ability to see all of Alice’s transactions. It will also create a single point of failure, since Alice will only have one channel, and if the ACINQ node is not available, Alice will not be able to make payments. To keep things simple at first, we will accept these trade-offs. In subsequent chapters, we will gradually learn how to gain more independence and make fewer trade-offs!

Alice selects ACINQ Node and is ready to open her first channel on the Lightning Network.

Opening a Lightning Channel

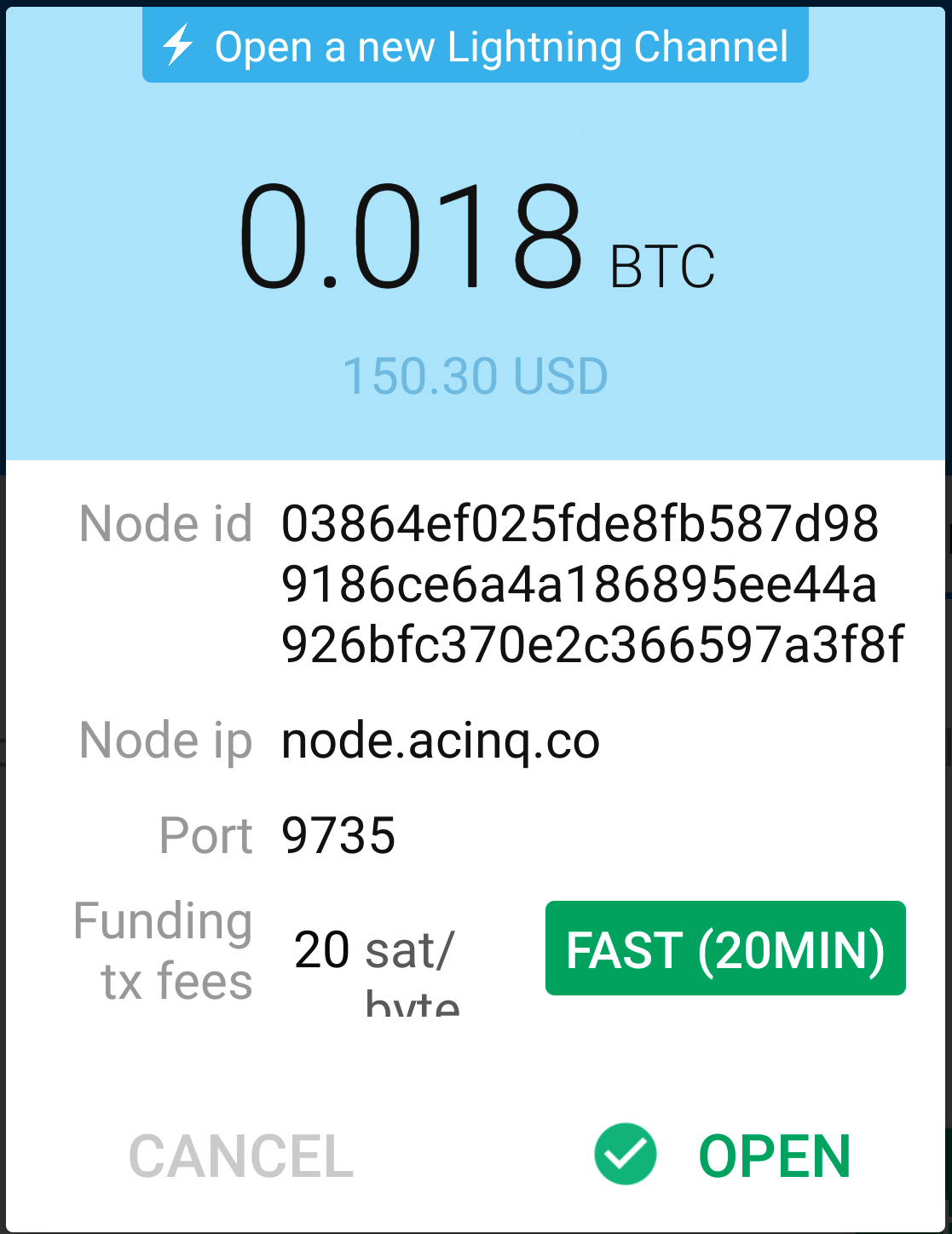

When Alice selects a node to open a new channel, she is asked to select how much bitcoin she wants to allocate to this channel. In subsequent chapters, we will discuss the implications of these choices, but for now, Alice will allocate almost all her funds to the channel. Since she will have to pay transaction fees to open the channel, she will select an amount slightly less than her total balance.[6]

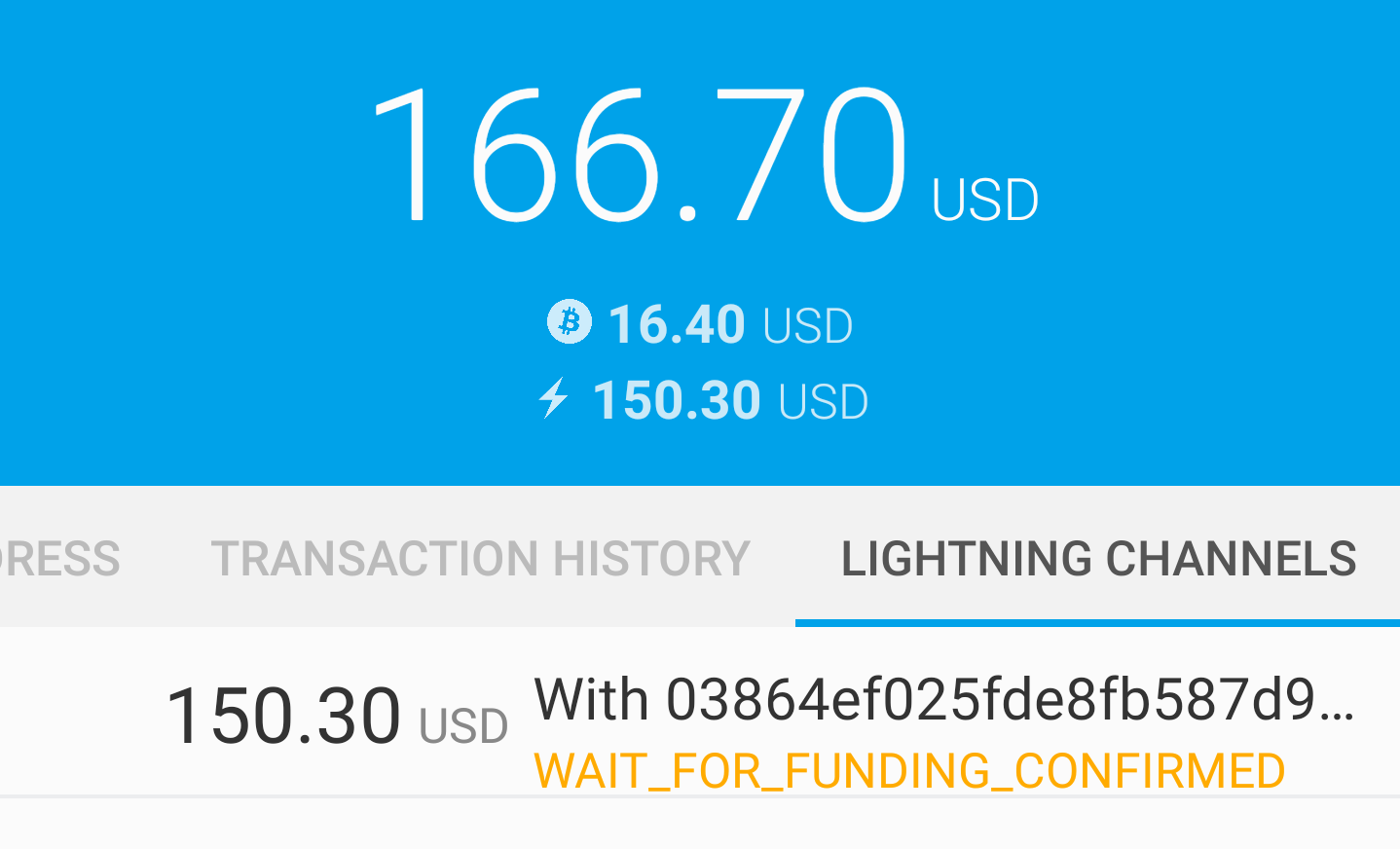

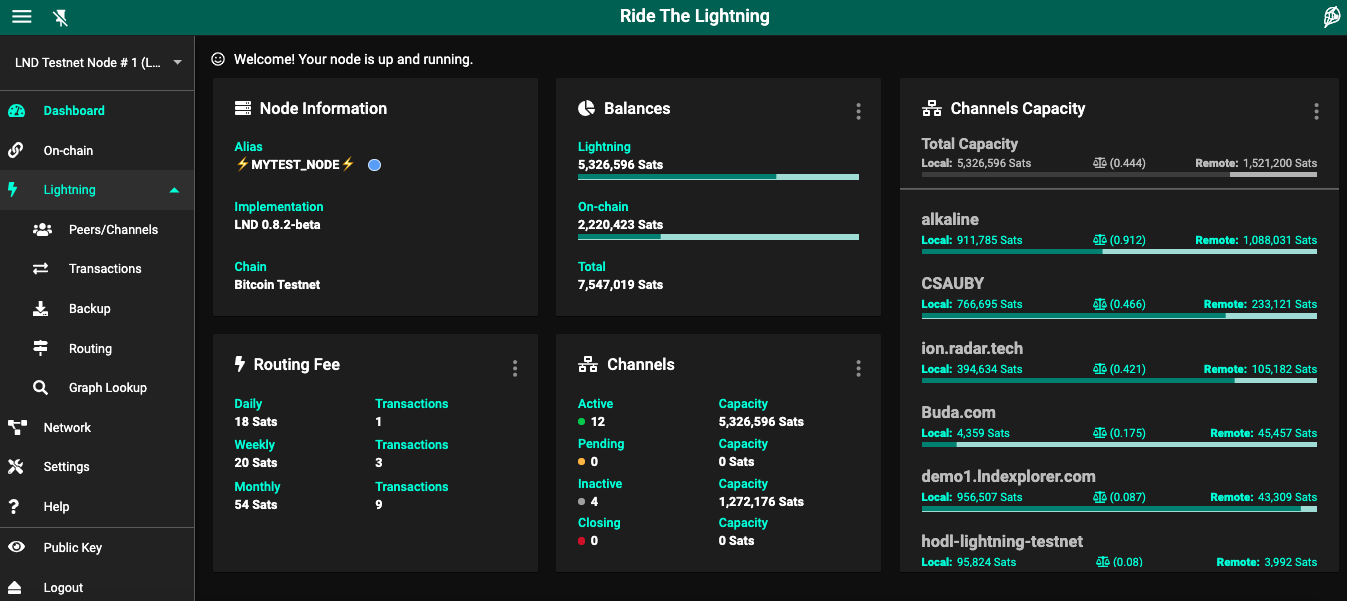

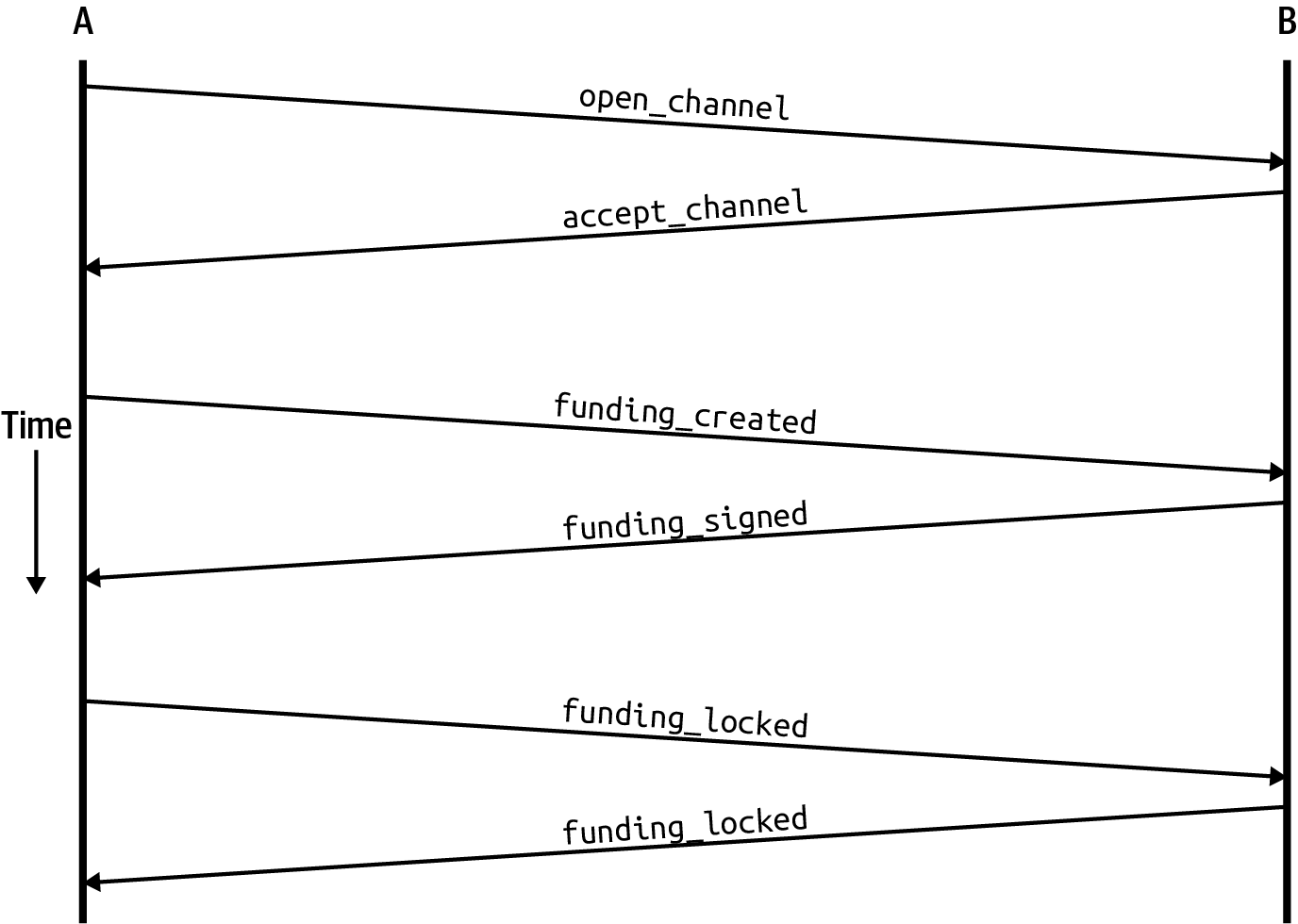

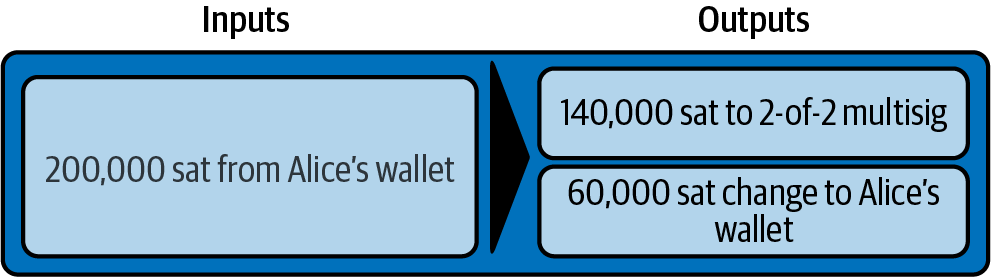

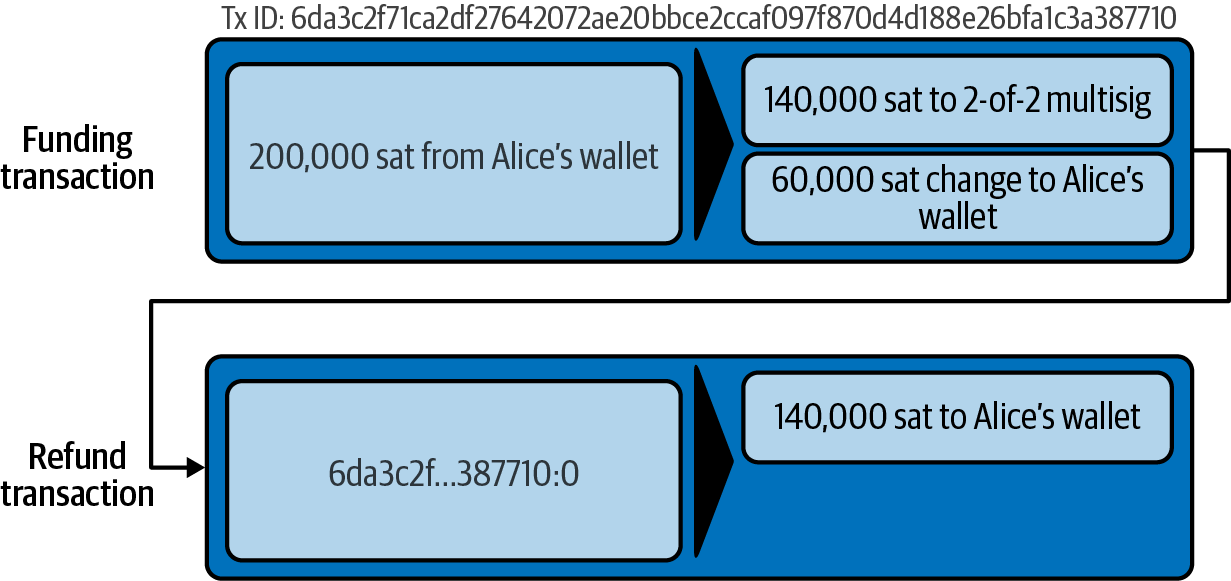

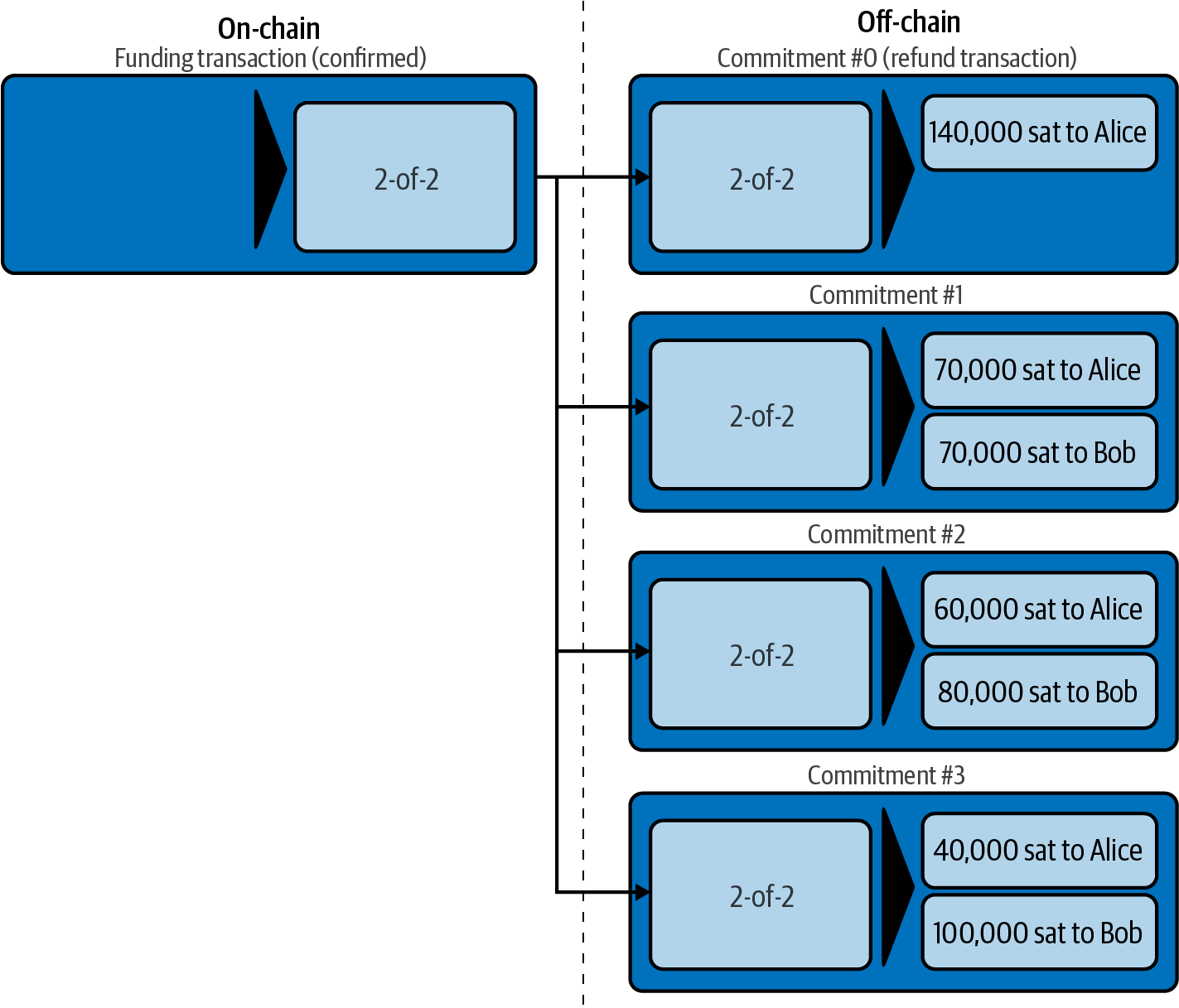

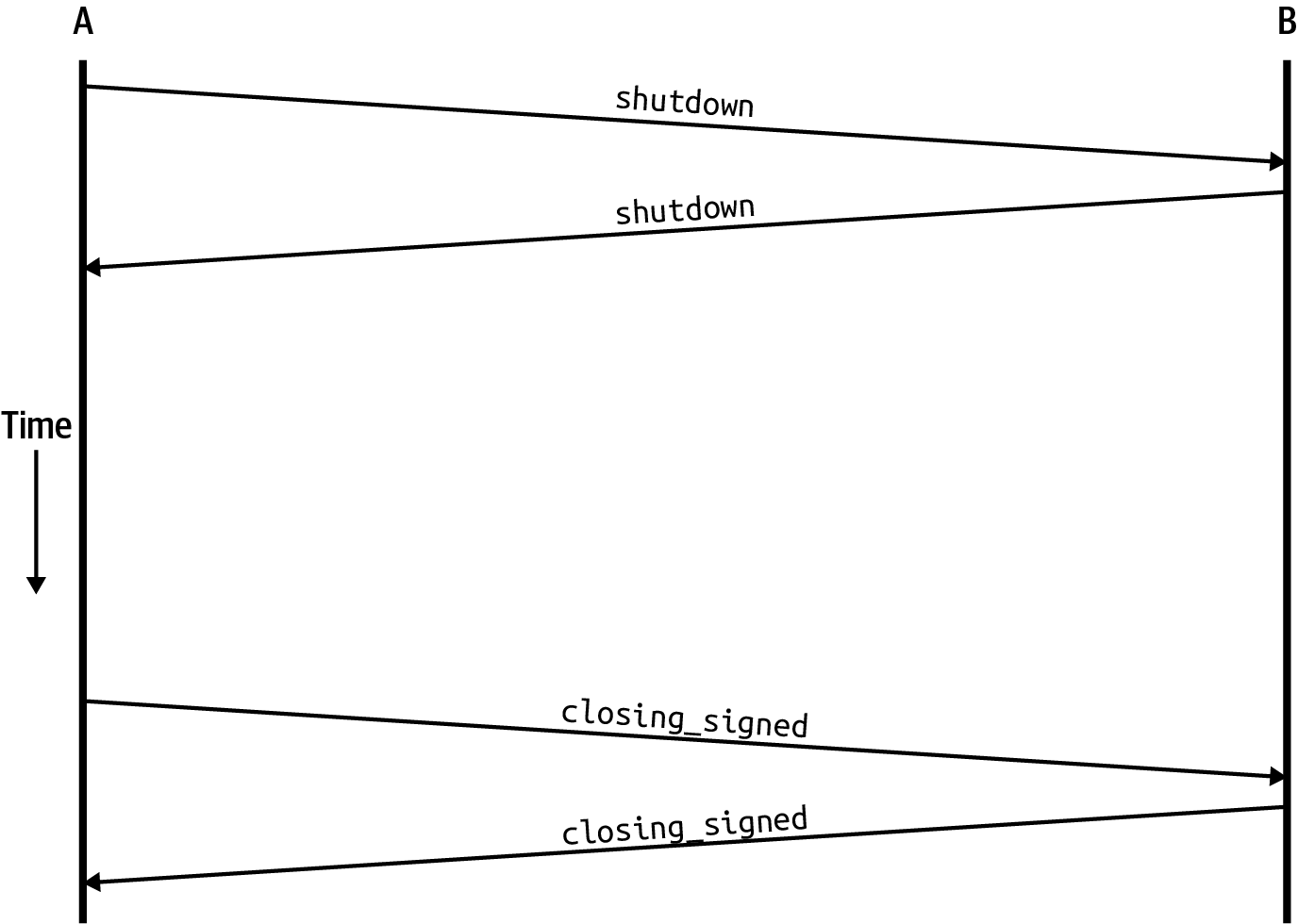

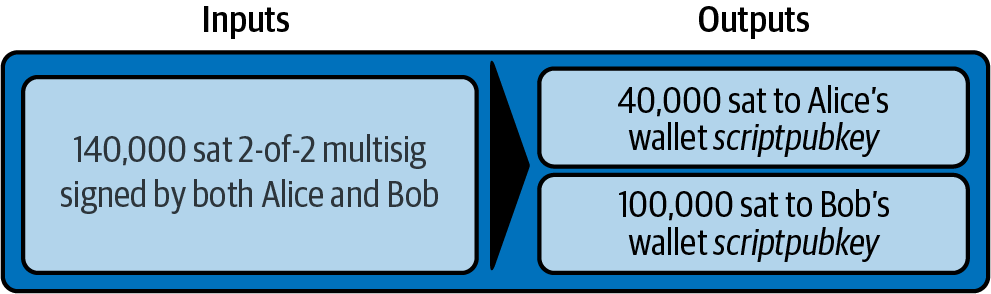

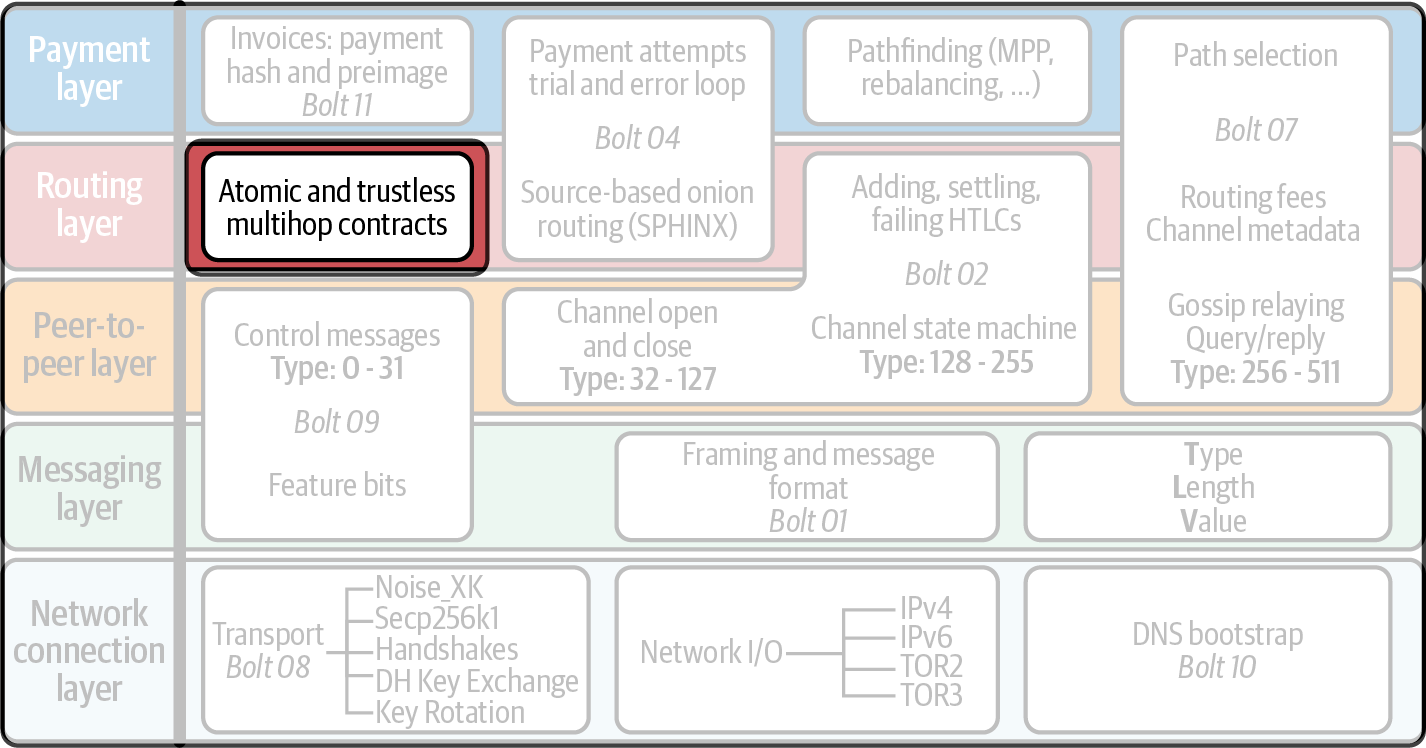

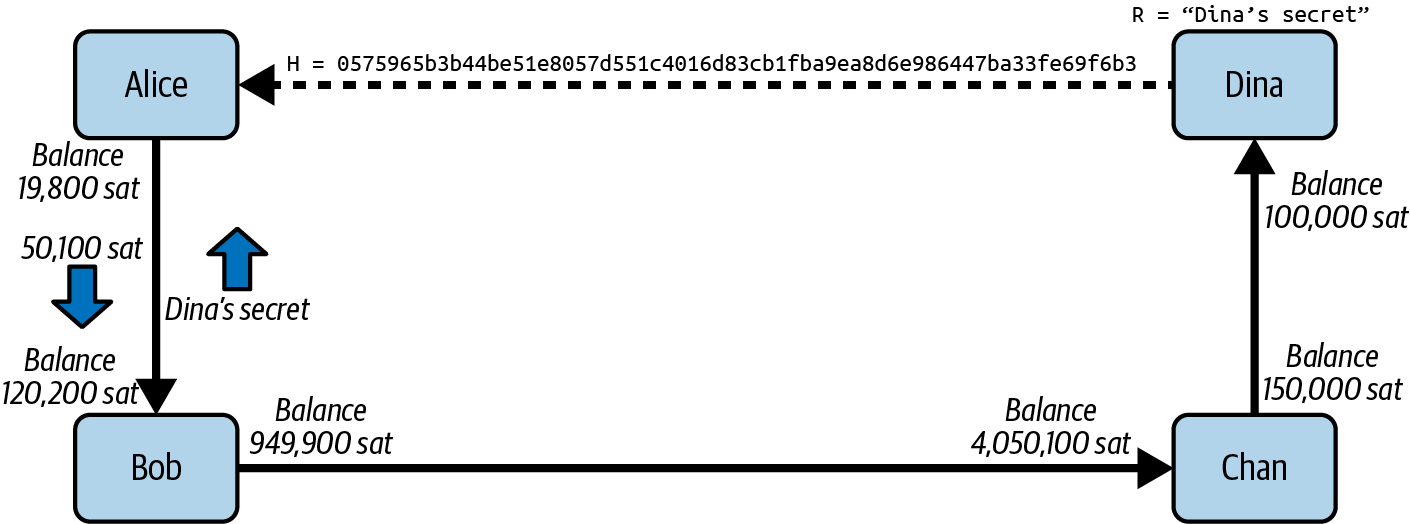

Alice allocates 0.018 BTC of her 0.020 BTC total to her channel and accepts the default fee rate, as shown in Opening a Lightning channel.